Listen to This Blog Post

Over the past several years, extended equity market cycles have led to meaningful changes in market structure—particularly the rising dominance of large cap among U.S. stocks and the growing share of U.S. equities in global benchmarks. When working on asset-allocation plans or equity structure projects, we advocate strongly for using market cap weights as the default starting position in both areas. Clients can implement tilts away from these starting points where they have strong conviction.

The salient question then becomes: How do you define the market cap weight? Is it the allocation as of the most recent date, or some longer time frame? In U.S. equities we anchor to 85% large cap, yet the market weight has grown to almost 90%. In global equities we anchor to 60% U.S. even as the region weight has risen closer to 70%.

The Market Cap Weight Decision

In this post we make the case for taking a long-term view when setting default allocations. We think it is sensible to wait before changing your default market weight.

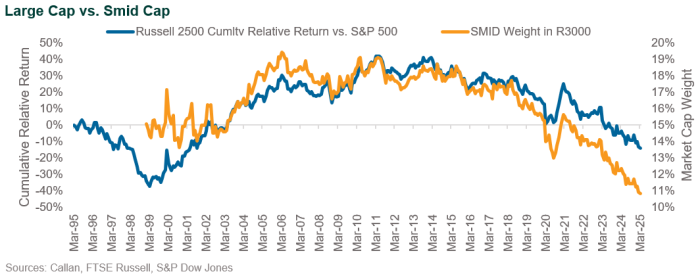

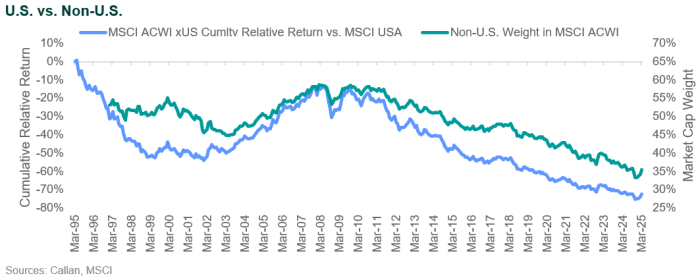

Let’s start with the most common argument for being patient with market-based bogeys. Markets go through cycles in which different capitalizations or regions go in and out of favor. It gets more challenging when the cycle extends out in length and a certain bias fails to pay off for a long period of time, as we have seen with small cap relative to large cap, and global ex-U.S. relative to U.S. equities. The charts below show the cumulative relative returns for size and region factors. This measure is a ratio of the cumulative return of one index relative to a reference benchmark and shows the cycles we noted. Overlaying the index weight for the corresponding factor highlights how performance cycles influence market cap weights.

One could take the common next step and show how different size or region allocations perform as these market regimes shift and factors go from being in favor to being out of favor. That type of analysis is often shown, so we will spare you the numbers and simply make the intended point. If you are overweight a factor when it is in favor, your performance will be better, all else equal. However, if you shift your portfolio allocation along with the market cap weight, you will be most overweight to a given factor just before the market cycle turns in the other direction.

We always recommend that clients should only implement tilts in areas where they have strong conviction. That means sticking with a market tilt when it is working and when it is not working. Human nature means we’re good at the former part of that conviction and not so good at the latter part. In short, clients should follow the market into higher large cap and U.S. region allocations only if they believe:

- The market cycle will continue for some structural reason.

- They can maintain conviction and stick with those weights even if the market cycle takes those factors out of favor.

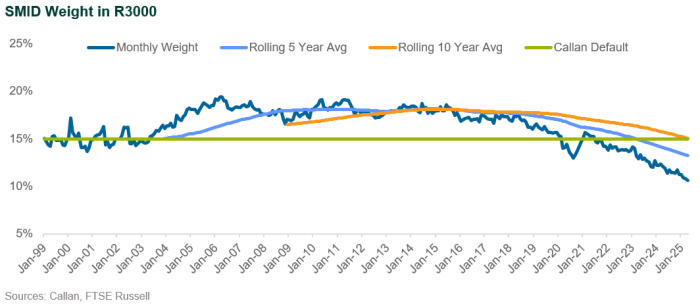

In closing we will make an even simpler argument for being patient with market-based bogeys. As long-term investors we should let long-term data inform our default starting position. Within U.S. equities, Callan historically anchored to 80% large cap and 20% small/mid cap. We moved to 85% large cap and 15% small/mid cap in 2021 after much consideration. Within global equities we have always anchored to 60% U.S. and 40% global ex-U.S. That used to represent a home country bias until the market caught up with us and eventually surpassed us.

The charts below illustrate that an investor looking at a 5- or 10-year history would not have a compelling reason to move from our 85/15 or 60/40 bogeys. Aligning your default position with your time horizon makes sense on the surface and has the added benefit of resisting a factor overweight that just might turn against you, if history is any indication. Clients are asking if they should change their target weights to large cap and U.S. equities. Our answer? Wait.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.