Capital Markets Assumptions and the Future

CEO and Chief Research Officer Greg Allen and Senior Vice President Julia Moriarty analyze how Callan’s capital markets assumptions have compared to actual returns.

Rebalancing in a Time of Volatility

With the sharp decline in equities worldwide, many institutional investors find themselves overweight fixed income and underweight equities. In many cases, strategic policy ranges set by the long-term planning process have been breached. Given all of the uncertainty and market volatility, many of our clients are wondering what to do next. Should the portfolio be […]

Have We Learned the Lessons of the GFC About Liquidity?

After a 10-year bull market in equities, the Global Financial Crisis (GFC) may seem like a distant memory. Yet the financial lessons of those times should be branded into our memory as fiduciaries. As financial markets collapsed, the lack of liquidity across all asset classes had serious consequences and limited the ability of institutional investors […]

Follow the Money: Asset Flow Data Support Industry Trends

Twice a year, Callan takes a deep dive into asset flow data to extrapolate trends and identify the most successful investment managers in each asset class. What we found in our most recent analysis, for year-end 2017, is consistent with many of the broad challenges the institutional asset management industry is facing. However, this analysis […]

Untangling the Gordian Knot of ‘Cash Drag’

Modern portfolios are increasingly complicated as they have expanded beyond stocks and bonds. The management of those portfolios—and the attendant illiquidity that can come with alternative investments—has many asset owners staring at a Gordian knot very much in need of untangling. With Alexandrian efficiency, a futures-based cash overlay can slice through many of the issues complicating cash […]

Rebalance Your Portfolio, or Let It Ride?

With the return of market volatility, investors are asking whether it is an appropriate time to rebalance their portfolios. Our view: Yes! This sometimes-overlooked procedural discipline is extremely important. Asset allocation may be the most important decision fund sponsors make as fiduciaries for their investment program. The key to the success of an investment program […]

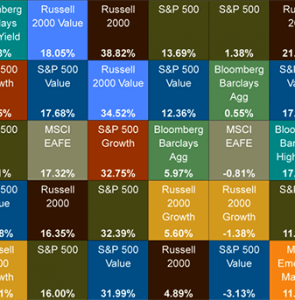

New Feature: A Monthly Periodic Table

Monthly Table ‘Classic’ Table All Tables Callan has long used our Periodic Table of Investment Returns to highlight for clients and other institutional investors the advantages of diversification over the long haul. The table ranks asset classes by performance over various time periods, and over the years we have created specialized versions (such as equity-only, […]

Fixed Income Observations

View Research How are investors responding to the prospect of rising rates? Here’s a look at plan sponsors’ reactions and some potential enhancements to the fixed income structure. Public funds, endowments, foundations, and Taft-Hartley plans have all steadily reduced their allocations to fixed income; the one exception, corporate funds, has been increasing fixed income exposure […]

Capital Market Projections 2017

View Charticle View Research Each year, Callan develops long-term capital market projections, detailing expected return, standard deviation, and correlations for major asset classes. These projections are the cornerstone for strategic planning. From our Capital Markets Research group: Over the next 10 years, we forecast annual GDP growth of 2% to 2.5% for the U.S., 1.5% to 2% […]

Risky Business

Download PDF Interest rates are historically low in the U.S. and abroad. Couple this with modest growth, and fund sponsors reluctant to lower return expectations face one of the most difficult investing environments in history. To find out how difficult, our experts wondered, “What would an investor need to do to achieve a 7.5% return […]