Callan’s 11th annual Defined Contribution (DC) Trends Survey found that plan sponsors continue to focus intensely on fees. Sponsors, by a wide margin, cited reviewing plan fees as the most important step they took in improving their fiduciary position in 2017, and 60% of survey respondents said they are somewhat or very likely to conduct a fee survey in 2018.

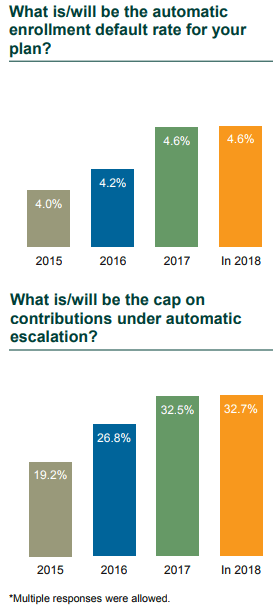

The survey also found that the use of auto features continued to be widespread. Nearly three quarters of non-government plans used auto enrollment; four out of five plans with auto enrollment also offered automatic contribution escalation; and plan sponsors reported the highest average auto enroll default contribution rate in the survey’s history (4.6%).

We have published the DC Trends Survey each year since 2007. This year’s survey includes responses from 152 U.S. DC plan sponsors, including both Callan clients and other institutions, with more than 80% having over $100 million in assets.

Other key findings from the survey:

- Consultants: Four out of five plan sponsors said they engage an investment consultant, but a third were unsure whether their consultant has discretion over the plan.

- Success: The three most important factors cited by plan sponsors in measuring plan success were participation, investment performance, and contribution rates.

- Revenue sharing: Plan sponsors reported a decrease in the use of revenue sharing to pay fees, with the most common fee payment approach reported as explicit per participant fees (54.7%).

- Communication: Plan sponsors most commonly reported that their area of communication focus in 2018 will be financial wellness.

- Recordkeepers: Almost half of plan sponsors said their recordkeeper would provide advice under the DOL’s Fiduciary Rule; however, that same amount did not know what they will require their recordkeeper to provide in 2018 in order to monitor advice given. Also, one in six plan sponsors intends to conduct a recordkeeper search in 2018.

- TDFs: More than half of plan sponsors took action with regard to their target date funds in 2017; 52% of those taking action evaluated their target date glide’s path suitability for their plan.

- Fund changes: U.S. small/mid cap equity funds were the top fund to be added in 2017, and among the most likely to be eliminated in 2018.

- Plan leakage: The percentage of plans with a policy for retaining retiree/terminated assets climbed to 61%, with half pursuing a policy of seeking to retain these assets.

Along with the data in our quarterly Callan DC Index™ and Target Date Index™, this survey paints a detailed picture of the challenges and opportunities that are top of mind for DC plan sponsors this year.

61%

Percentage of plans with a policy for retaining retiree/terminated assets