Our 2024 Defined Contribution Trends Survey covers the key tenets of DC plan management such as governance, investments, fees, plan design, and more. The insights distilled in the 17th annual edition of our survey provide a benchmark for sponsors to evaluate their plans compared to peers, and to offer actionable information to help them improve their plans and the outcomes for their participants.

This blog post summarizes highlights from the survey, which was conducted online in late 2023. This survey incorporates responses from 132 DC plan sponsors, both Callan clients and other organizations. Respondents spanned a range of industries, with the top being financial services and government. Nearly 90% of plans in the survey had over $200 million in assets, and 58% had more than 10,000 participants. More than two-thirds of respondents were corporate organizations, followed by public (16%) and tax-exempt (15%) entities.

Other Highlights from the 2024 DC Survey

Oversight

- Consistent with prior years, DC plan sponsors were largely focused on their investment policy statement (IPS), reviewing plan fees, and the investment structure in 2023. These will also be top areas of focus in 2024, with reviewing plan fees as the highest (74%).

- Plan governance and process has consistently ranked as one of the top-rated areas of focus. This broad category includes much of the basic blocking and tackling that sponsors do on an ongoing basis. Investment management fees have also ranked as a top area of focus year over year.

- In line with the past three years, most sponsors used participation rate to measure success.

Investments

- In 2023, 94% of plans offered a target date suite and 90% used a target date fund (TDF) as their default for non-participant-directed monies.

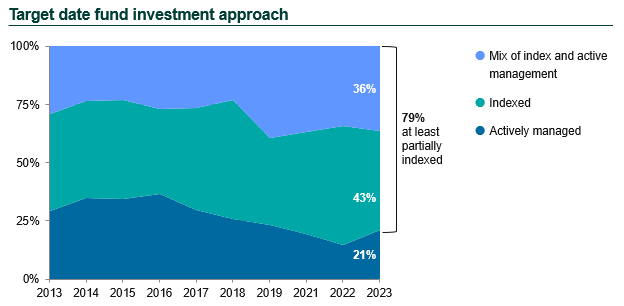

- Among those that offer TDFs, nearly 8 in 10 used an implementation that was at least partially indexed. The share of active-only strategies rose to 21% in 2023 from 15% in 2022, its lowest point in our survey’s history.

- Guidance on appropriate benchmarks for TDFs has been limited to date. SECURE 2.0, passed in December 2022, directed the DOL to issue regulations providing that, in the case of an asset-allocation fund, the plan administrator may, but is not required to, use a benchmark that is a blend of different broad-based securities market indices. This guidance is required within two years.

- While all respondents indicated they benchmark their TDFs, nearly 8 in 10 reported using multiple benchmarks, indicating that plan sponsors are seeking a more nuanced evaluation.

- Over 7 in 10 plans took at least one action around the target date fund suite in 2023. The most common were to evaluate the suitability of the underlying funds and the suitability of the glidepath.

- The prevalence of mutual funds for the TDF continued its decline. In 2010, 67% of plans used a mutual fund for their target date fund compared to 42% in 2020. This decreased notably further in 2023 to 28%.

- There was a large increase in DC plans offering an active/passive mirror versus those offering a mix of active and passive funds, with a mirror coming in at an all-time high of 45%. A mirrored lineup is when virtually all core asset classes are represented by both active and passive options.

- DC plans with a mix of active and passive investment funds (91%) were the most prevalent. Purely passive (9%) lineups remained a rarity, with a purely active menu being even more rare (1%).

- Collective investment trusts (CITs) and mutual funds continued to be the most prevalent investment vehicles, with CIT usage only recently surpassing that of mutual funds.

- Only 18% of plan sponsors reported making changes to the number of funds in 2023. Roughly the same percentage indicated they are planning a change in 2024. Of those that made changes in 2023, there was an even split between those increasing the number of funds and those decreasing the number.

- More than three-quarters of plans did not offer an environmental, social, and governance (ESG) fund in the core fund lineup. But 9% will consider adding an ESG option in the future and the other 15% already do.

- More than a third of the sponsors in the survey conducted an investment structure evaluation within the last year, in line with previous years. More than 93% have conducted an evaluation within the last five years.

Fees

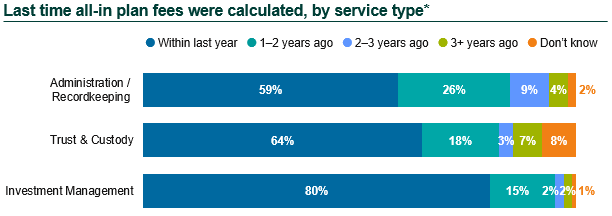

- All-in administration fees can encompass a variety of expenses, including administration, participant transaction fees, compliance, custody, communications, and indirect sources of revenue. About 6 in 10 plan sponsors calculated their administration DC plan fees within the past 12 months. Another 26% did so in the past one to two years.

- Higher levels were seen for investment management fees; as a major target of litigation, reviewing the investment management fees regularly is considered best practice.

- When calculating fees, over half of respondents also evaluated sources of indirect revenue (e.g., revenue shared with the recordkeeper from managed accounts, brokerage windows, IRA rollovers, etc.).

- Fewer than half of plan sponsors kept fees the same following their most recent fee review, while nearly half reduced fees.

- Investment management fees were most often paid entirely by participants (89%), and almost always at least partially paid by participants (92%). By contrast, 66% of all administrative fees were paid entirely by participants, up significantly from three years ago (49%). Most plan sponsors (82%) noted that at least some administrative fees were paid by participants.

- Two-thirds of plan sponsors are either somewhat or very likely to conduct a fee study in 2024. Most respondents also indicated they are very or somewhat likely to review other fee types (e.g., managed account services fees) and indirect revenue.

- Five in 10 respondents are likely to move to lower-cost investment vehicles (e.g., move from an R6 share class to a collective investment trust) in 2024, a notable increase from last year’s survey (42%).

- Only 16% of sponsors plan to explore a recordkeeper search in 2024, down from the last two years’ survey results (24% in 2022).

- Other somewhat or very likely actions include renegotiating investment manager fees (43%), renegotiating recordkeeper fees (42%), and rebating revenue sharing to participant accounts (39%).

Advice Services

- Over 70% of plan sponsors monitored their managed account services by reviewing participant usage and interaction, while just over 60% review fees and services.

- Plans reported high levels of satisfaction with investment advisory services. Full financial planning received the highest overall marks, with 100% of respondents very or somewhat satisfied.

- The service with the largest percentage of dissatisfied respondents was managed accounts.

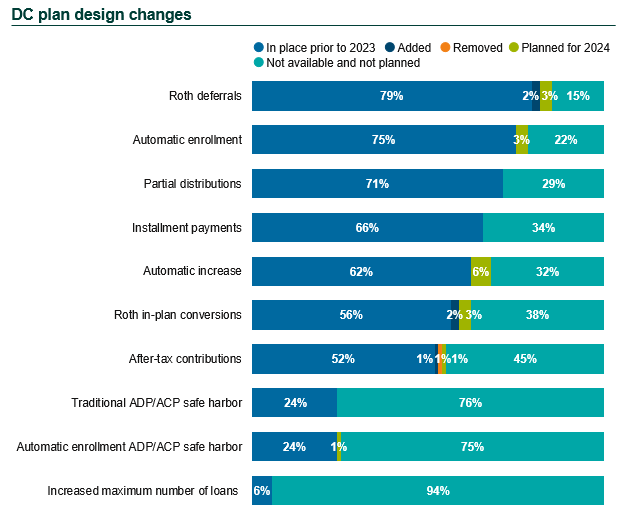

- Survey respondents noted that Roth deferrals (81%) and automatic enrollment (75%) were the most common enhanced savings features.

Plan Leakage and Post-Retirement Issues

- The majority of plan sponsors with a strategy around this issue sought to retain the assets of both retiree and terminated participants, a notable increase from 2015 (44%). More than 8 in 10 plans sought to retain retiree assets, while fewer sought to retain terminated participant assets (61%).

- Most plan sponsors reported taking steps to prevent plan leakage. Actions included offering partial distributions (74%), installment payments (72%), and encouraging rollovers in from other qualified plans (64%).

- Slightly fewer than half of survey respondents allowed terminated participants to continue repaying their DC plan loans.

- Most plans offered some sort of retirement income solution to employees by 2023. Installment payments (78%) and partial distributions (76%) were the most common. Providing access to a drawdown solution, managed accounts, or a defined benefit plan were the next most common.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.