The U.S. Department of Labor (DOL) announced a proposed rule in late October that would allow certain retirement plan disclosures to be posted online. This would result in reduced printing and mailing costs, make disclosures more readily accessible, and diminish the environmental impact of distributing physical notices. (It is noteworthy that a proposed rule on reducing paper mailings is 115 pages long.)

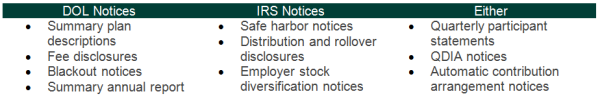

Background: Defined contribution (DC) plans must provide a myriad of ongoing notices and communications to participants. The timing, frequency, and rules for distribution vary based on the supervising agency, creating additional complexity for plan sponsors.

Historically, the rules on providing notices covered by the Internal Revenue Service (IRS) have been more liberal than the DOL’s. The IRS rules permit e-delivery if the recipient has reasonable access to the delivery system, the information is as understandable as a paper document, and the plan advises the recipient of the ability to request a free paper copy.

The DOL rules currently require that the participant have access to the plan sponsor’s electronic information system as an integral part of her duties or has affirmatively consented to electronic receipt. Additionally, participants must receive an annual notice explaining the availability of the information and how to access it, and advise them of their right to receive a free paper version of the information. (Note: The plan may use the DOL or the IRS e-delivery rules to provide this annual notice.)

The proposed rule more closely aligns the DOL electronic distribution rules with the IRS rules. Under the new rule, required communications may be posted to a website, so long as the affected participants receive a notice at their “electronic address” (i.e., an email address or smartphone number), and have the right to request a paper copy or opt out of the electronic communications program.

While the rule still requires some proactive outreach to participants—for each document that is provided online, the administrator must send a separate, electronic notice of internet availability—the administrator may send a combined notice with respect to certain documents: summary plan descriptions, summary annual report, investment-related portion of fee disclosure, QDIA notice, etc.

The new rule also requires that when an employee receiving electronic communications is terminated, the administrator must “take measures reasonably calculated to ensure the continued accuracy of the covered individual’s electronic address … or to obtain a new electronic address that enables receipt of covered documents.”

Bottom Line: Communicating relevant information to participants in an efficient fashion without overwhelming them is a chief concern for plan sponsors. Simplifying the distribution rules, coupled with a review of the varying deadlines, supports communication needs and can lower plan administration costs.