“Measure what you treasure” may sound trite, but it is at the heart of how institutional investors evaluate the performance of their portfolios. For private infrastructure allocations, “measuring that treasure” with the appropriate infrastructure benchmarks is more difficult than for other parts of institutional portfolios, even other private markets investments, given the shorter history of the asset class and its growing diversity of investments by type, location, and revenue-generation approach.

As they consider the most relevant benchmarks, institutional investors first need to determine the role infrastructure plays in their portfolio. Is it a core investment meant to yield appreciation and income? A fixed income replacement? A higher-octane investment focused on long-term value creation? Or is it some combination of these?

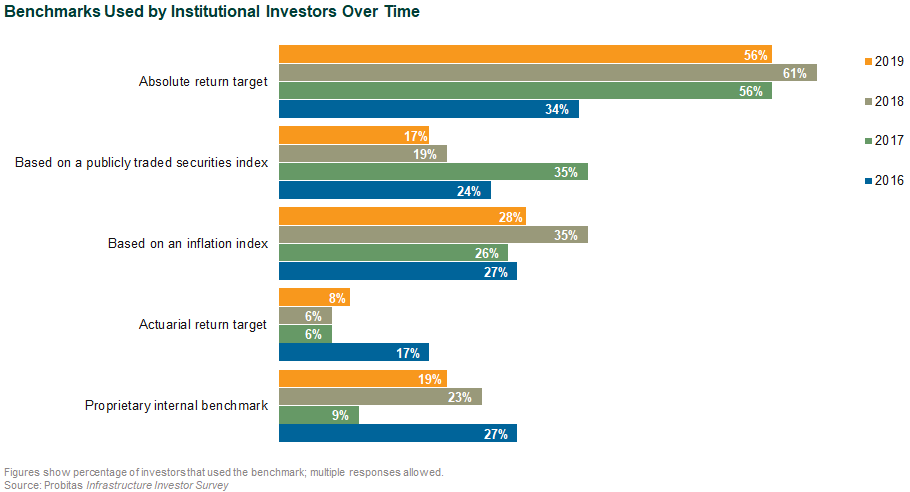

In the past, institutional investors have used a variety of benchmarks for infrastructure equity investments:

- Inflation-linked (e.g., CPI + 4%)

- Absolute return

- Listed (i.e., public) infrastructure indices

Listed infrastructure benchmarks have been more impacted by periods of market volatility and probably less useful than absolute return and inflation-linked benchmarks. Additionally, the opportunity set for public/listed infrastructure is different than the typical portfolio mix targeted by private infrastructure managers. At the same time, investors are starting to question the use of inflation-linked benchmarks given the recent spike in prices for consumers and producers, meaning absolute return benchmarks have become more popular.

How Infrastructure Benchmarks Are Evolving

As infrastructure matures as an asset class, the potential for more useful benchmarks will grow. Infrastructure initially started as part of institutional investors’ private equity portfolios, with high target returns and closed-end structures of 10-12 years. But now the range of investable options has expanded to include core (perpetual vehicles), value add, and potentially even opportunistic strategies, similar to the universe in private real estate.

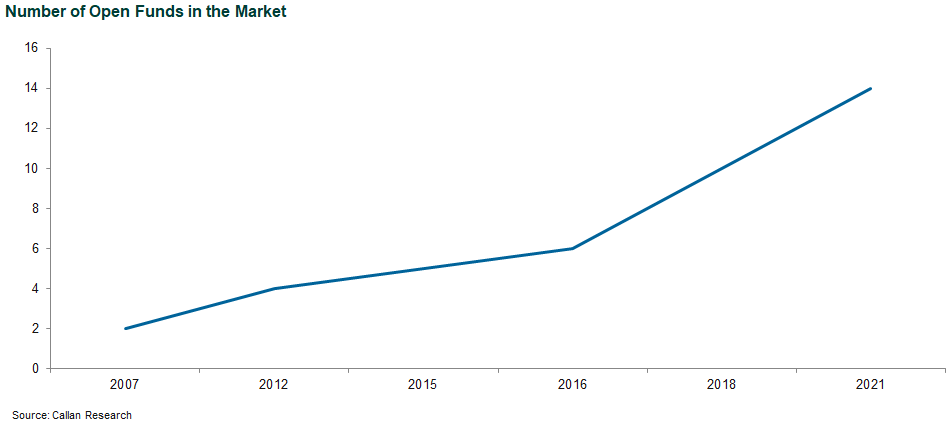

Private real estate investors often use the NCREIF Fund Index-Open End Diversified Core Equity (NFI-ODCE) as a benchmark, but there is no equivalent for infrastructure. The open-end infrastructure universe is less homogeneous than the ODCE universe (with more diversity in terms of country and sector exposure), and the number of open-end infrastructure funds with a track record of more than five years is limited.

Over time this will change; there are close to 15 open-end infrastructure funds in operation or about to launch, which could be useful for creating an ODCE-like index for the infrastructure sector. For comparison, there are 38 funds in the ODCE, which started with an inception date of Dec. 31, 1977.

One key question to address: “Is the manager achieving the objectives that it set out with, and how does it compare with peer funds?” At the moment, that is challenging for open-end funds because of the paucity of managers with longer track records, but as they mature, peer comparisons will become more practical. There are more closed-end funds operating, making peer comparisons more useful, but investors still need to understand the sectors and geographies their closed-end fund managers are targeting to make a better assessment of the relevant benchmark.

The good news for investors is that “measuring what they treasure” in their infrastructure portfolios will become increasingly sophisticated as the asset class continues its evolution and as more funds come to market to cater to the growing number and variety of institutional investors that are making allocations to this asset class. Investors will need to carefully decide on their benchmarks depending on the role of infrastructure in their portfolios and the investing approach of their managers, but the expansion of the asset class will provide them with more choices as they make those decisions.