Growing interest in environmental, social, and governance (ESG) investing is apparent across the institutional investment industry. ESG has also captured the attention of policy makers; for instance, the White House, the Senate Committee on Banking and Finance, the Labor Department, and the SEC have all addressed ESG in the past year. And we can read about regulatory activities, product proliferation, data advances, reporting frameworks, and other ESG issues daily in the media.

Despite the increasing momentum globally, consensus on some of the basics of ESG (aka sustainable investing) eludes many.

Enter the “ESG Mythbusters!” OK, not as catchy as the Avengers, but hear me out as I discuss how certain myths affect defined contribution (DC) plans, which have been slower to adopt ESG than other institutional investors, like sovereign wealth funds, nonprofits, or defined benefit plans.

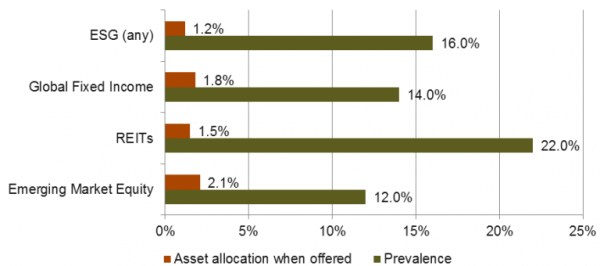

In a blog post a year ago, my colleague James Veneruso highlighted low ESG adoption rates in Callan’s DC Index™. He found that 16% of DC plans offer a dedicated ESG option, with a fairly low utilization of 1.2% when offered, roughly on par with global fixed income and emerging market equity.

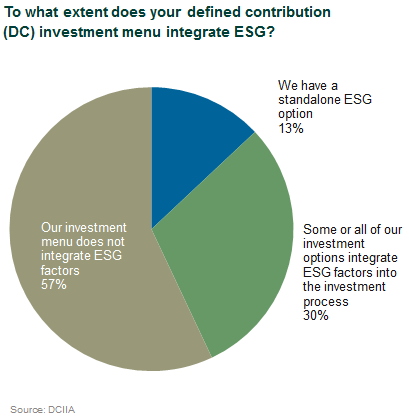

Similarly, a survey by the Defined Contribution Institutional Investment Association (DCIIA) in 2018 found that 13% of DC plans had a standalone ESG option.

However, ESG integration was much more prevalent: nearly one-third of plans in this survey indicated that at least some of their options integrate ESG into the investment process.

So what is the difference between offering an ESG option and integrating ESG, and why is it important to DC plan governance? As DC plan administrators are looking at whether or not ESG is right for their plan, we see a clear need for education around this topic and others, such as financial materiality and ESG’s impact on returns, to establish a common ground for productive discussions about implementation.

I recently co-authored a paper with other DCIIA members (my fellow Mythbusters) to address this need. In “Sustainable Investing in Defined Contribution Plans: A Guide for Plan Sponsors,” we aim to provide plan sponsors with a base level of knowledge about ESG/sustainable investing and integration by clarifying terminology and focusing on areas that historically have been misperceived. We tackle four myths that obfuscate discussions around ESG adoption:

- Myth #1: There is insufficient research to support sustainable investing

- Myth #2: Plan participants are not interested in sustainable investing

- Myth #3: Adding an ESG-themed fund or requiring ESG integration is incompatible with fiduciary responsibility

- Myth #4: Adding an ESG-themed fund in a DC plan and ESG integration are the same thing

While it may be a stretch to compare the financial wonks of the retirement industry to superheroes (although I call dibs on “Raucous Researcher” if we’re claiming superhero names!), I think this type of myth-busting promotes a more level playing field for administrators. Knowledge is power, and understanding how ESG fits within an investment framework and can be another tool to engage workers in saving for retirement will lead to well-informed decision-making on behalf of plan participants.