“I’m pickin’ up good vibrations…”

— Brian Wilson, The Beach Boys

There is no shortage of “good vibrations” around the environmental, social, and governance (ESG) space. While ESG was once the purview of niche managers, it has gained broader acceptance—many investment managers now boast dedicated ESG research teams.

In another broader sign of the times, the number of signatories to the U.N.-backed Principles for Responsible Investment swelled from fewer than 100 in 2006 to over 1,800 in 2017, with a comparable increase in assets under management (see UNPRI.org for more information). The PRI is an organization that outlines a set of principles to help investors incorporate ESG issues into their investment process.

Despite this growth in interest in the institutional investing industry, defined contribution (DC) plans remain somewhat skeptical about these good vibrations. According to Callan’s DC Index™, 16% of DC plans offer a dedicated ESG option. However, this number masks a large divide among plans: Only 5% of corporate DC plans offer a standalone option, compared to the 43% of public and non-profit plans that do so.

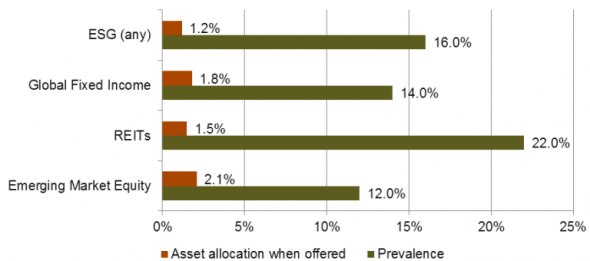

In addition, utilization for both sponsor types remains low. Allocations range from a barely perceptible 0.23% to 3.10% of plan assets, with an average of 1.20%. These utilization and prevalence numbers are on par with the experience of emerging market equity, REITs, and global/non-U.S. fixed income.

ESG Prevalence in Plans

Source: Callan

Plan sponsors facing the decision to add an ESG option should consider the following:

- Which ESG options are available: The two most common approaches are global equity (available in 46% of plans with an ESG option) and balanced funds (54%). Balanced funds may be more suitable if participants are apt to put their entire balance in an ESG option. However global equity options are simpler in that they do not have to consider fixed income in an ESG framework.

- What the rules are: The Department of Labor recently issued a new rule on guidance about ESG in an ERISA context. The DOL had indicated that ESG considerations could be considered a “tiebreaker” if funds were identical in all other facets and in 2015 built upon the “tiebreaker” language by asserting that ESG factors “may have a direct relationship to the economic and financial value of an investment. When they do, these factors are more than just tiebreakers, but rather are proper components of the fiduciary’s analysis of the economic and financial merits of competing investment choices.” The new rule, though, cautions fiduciaries about too readily linking ESG factors as being economically relevant. Given the DOL stance, plan sponsors that are beholden to ERISA and are looking at adding an ESG option should evaluate how and to what extent ESG factors are economically and financially relevant.

There is no doubt that interest, assets, and internal manager resources are growing within the ESG space. It remains to be seen though, how DC plan sponsors will adjust to the increasing attention and rising number of ESG options.