“We’re gonna be in the pool, we’re gonna be in the clubhouse and all over that shuffleboard court!”

~Frank Costanza

For a generation, “Seinfeld” captured the stereotypical view of retirement: Snowbirds from the Northeast living in (and engaging in the petty rivalries of) Del Boca Vista and enjoying a life of leisure.

In reality, the face of retirement is shifting. Gone are the halcyon days of shuffleboard, “early bird” specials, and lounging by the pool. Retirees are increasingly turning to a less binary view of retirement in contrast to the choice that was either work or retire. Whereas past generations often retired and dreamed of a life of leisure in warmer climes, many retirees now mix work with leisure. Just consider these statistics:

- 13% of workers plan to never retire, a story in The Wall Street Journal noted.

- Those aged 65 or older working or seeking paid work doubled from 1985 to 2019, according to a United Income analysis of the Current Population Survey.

- Nearly a quarter of Uber drivers are over the age of 50, a story on CNBC.com pointed out.

So how did we get here? Government policies around what we call retirement began in the late 19th century as the workforce moved from agrarian to industrial employment. Given the physical, mundane nature of much work, the idea of a life of leisure carried appeal for many. At the same time, people saw work as a way to earn a living. The notion of work as a passion or something to be enjoyed is more recent.

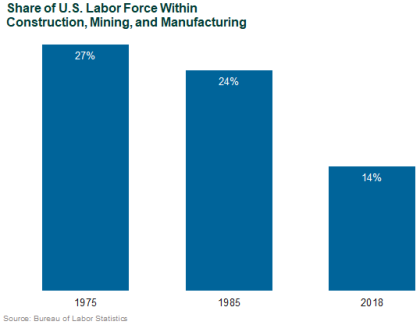

But over the last several decades, there has been a marked drop in the share of the U.S. labor force employed in physical occupations. The shifting nature of the workforce may help explain some of the change in how people perceive work.

These changing perceptions of retirement carry implications for policy and retirement plan design. They challenge many of the underlining assumptions we use to gauge success (e.g., achieving a balance to sustain level spending over “retirement”). The evidence of changing perceptions and expectations for retirement demands more understanding as we shape plan design and policy to support better outcomes for this transitional phase of life.

Over the coming months we will publish several blog posts to dig into how plan sponsors can adopt current practices to better accommodate the changing notions of retirement. In particular we will examine:

- Methods to gauge success

- Options for retirees remaining in plans

- Differing approaches to engaging with the various groups within retirement plans