Diversification is a central tenet to building a successful investment program—improving outcomes by limiting risk and taking advantage of broader exposure. The same holds true with an organization’s workforce: Employers benefit from a diverse population, as these individuals bring unique perspectives to the workplace.

For many defined contribution (DC) plan sponsors, understanding the diversity within the employee population supports inclusiveness and equality in access and opportunities, through financial literacy, plan design provisions, and ease of use.

DEI in DC Plans: No ‘Right’ Way

While there is no “right” way to integrate diversity, equity, and inclusion (DEI) into DC plans, plan sponsors and committees can seek to understand the circumstances and background of their employee population to ensure their disparate needs are being met. When viewed through a DEI lens, a successful DC plan addresses unique savings patterns and planning needs for different employee groups. This focus could include efforts to improve plan participation, increase savings opportunities, and minimize the impact of loans and early distributions. While ERISA defines discriminatory thresholds solely based on income (i.e., highly compensated vs. non-highly compensated), understanding the underlying characteristics of different employee groups, based on elements other than compensation, can help plan sponsors improve the plan utilization and effectiveness.

In Callan’s 2023 Defined Contribution Trends Survey, we asked plan sponsors how they approached DEI in their DC plans. Overall, a clear majority of plan sponsors indicated an interest in expanding DEI efforts (57%). Larger plans, with more than $1 billion in plan assets, were more likely to express an interest, compared to smaller plans.

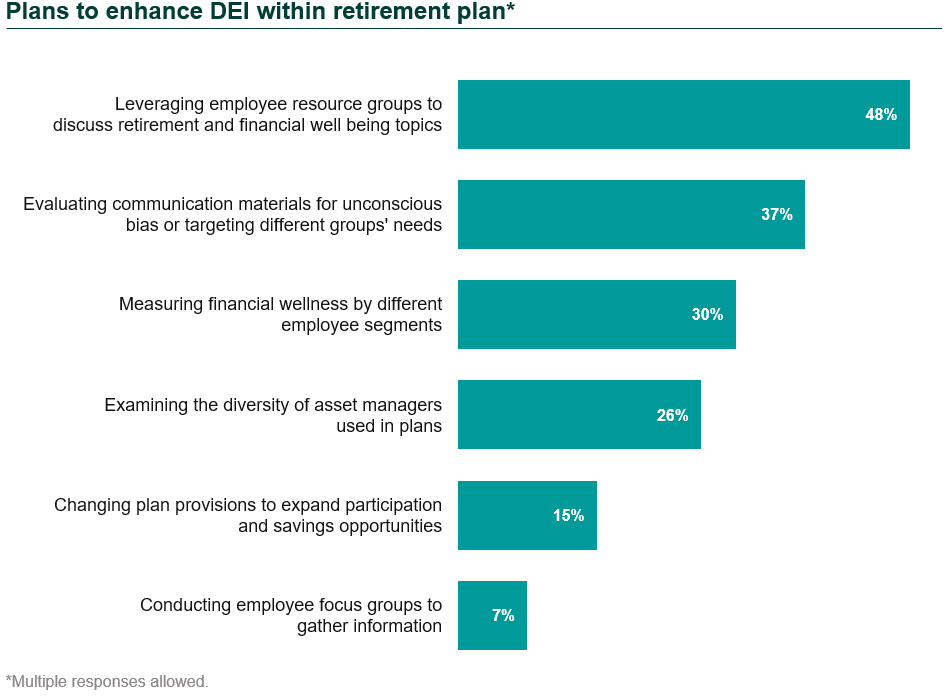

Sponsors can explore DEI initiatives to understand what is appropriate for their plans by assessing participant savings behaviors, evaluating communications, reviewing the committee makeup, and confirming the investment lineup meets the needs of differing groups. Nearly half of respondents in the 2023 DC Survey indicated they plan to enhance DEI by leveraging employee resource groups to understand retirement and financial needs, since exploring saving challenges and retirement needs from representatives of diverse participant groups can bring differing perspectives. Additionally, almost 4 in 10 respondents said they recently evaluated plan communications with a specific focus on DEI. This could include a review of unconscious bias in text or exploring where it could behoove the plan sponsor to focus communication efforts.

Sponsors can adapt their periodic reviews of benefits and their design, features, and communications to ensure that all groups are presented with, and able to take advantage of, the participation and savings opportunities the plan offers, and to monitor the achievements of those groups at various career stages. DEI in the investment selection process can address weaknesses or roadblocks to participants’ savings behaviors. Some plan sponsors may seek to add a brokerage window to permit participants with religious prohibitions to be able to save in the plan. Additionally, one-quarter of respondents indicated they plan to include a review of asset managers’ diversity.

Plan design can also address DEI needs by tackling loan and withdrawal trends, or participant and savings rates. Some plan sponsors noted that they address DEI via automatic enrollment, automatic escalation, and non-matching employer contributions. Alternatively, the new emergency savings account options authorized by SECURE 2.0 and effective beginning in 2024 may help participants save for the short-term within the plan and receive matching contributions on emergency savings deferrals.

As DEI principles are increasingly embedded within the employee benefits framework, plan sponsors have an opportunity to identify their preferred strategy, how to implement it, and how to measure success.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.