We saw a change in tone in economic forecasts coming in over the past six weeks, from one of certain recession in 2023 or at the least 2024, to one of “no recession here.” We see it in the tea leaves of the Fed’s releases after its last couple of meetings and in investment managers’ updates and strategy pieces, and now the professional forecasting community is, well, forecasting no recession this year or next.

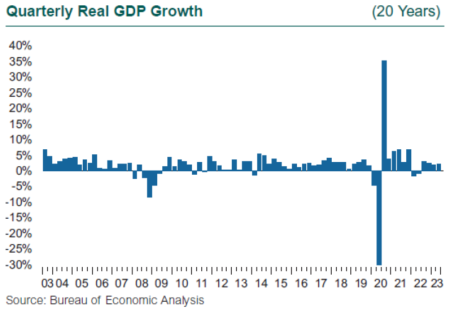

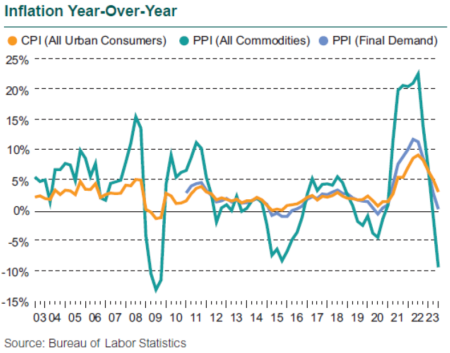

What happened? First, the job market remains robust, with unemployment stuck at a generational low. Second, inflation dropped from an alarming 9% rate last June to 3% in just one year. In the broad economy, GDP rebounded from two quarters of decline in 2022 to log four consecutive quarters of solid growth, notching 2.4% in 2Q23. Expectations established just six months ago had a recession hitting in 2Q or 3Q of this year. Now it is rare to find a shorter-term outlook (12-18 months) with a recession as the base case; we’re back to the notion of a soft landing, with GDP gently declining to 1%-1.5% growth in 2024. Did recession risk really disappear?

Interest rates could rise more in the second half of 2023, even though inflation is now down at 3%. The Fed has suggested two more rate hikes are in their cards. The strength remaining in the economy after rates rose 5% in one year gives the Fed headroom to further flex its inflation-fighting chops. The bond market has been expecting a recession since last July, when the yield curve inverted, and there is growing sentiment that perhaps this time, bond investors just might be wrong. The argument is that the bond market got ahead of itself in the spring of 2022, when it immediately and (almost) fully priced in the expected Fed moves by June last year. Then almost as quickly as the market believed the Fed would execute as telegraphed, the market began doubting the resolve of the Fed and the ability of the economy to absorb the historic jump in interest rates, and hence the inversion of the yield curve.

Employment Trends in the U.S. Economy

The strength of the job market has been Fed Chair Jerome Powell’s secret weapon, and we have been looking at the details of the job market with great interest. The U.S. economy recouped the nearly 20 million jobs lost in the first months of the pandemic by the middle of 2022, and now supports 4.3 million more non-farm jobs than at the end of 2019. However, some sectors are still woefully short of workers, and many observers believed a recession was necessary to convince people to take the jobs they no longer wanted in hospitality (hotels and restaurants), retail trade, and state and local government. These three sectors make up 34% of the U.S. job market, but all three have yet to surpass their pre-pandemic levels of employment; in fact, they are still 300,000 behind. That means only two-thirds of the job market has accounted for the 4.3 million new jobs. These lagging sectors have large concentrations of lower-paying jobs, so the differential growth in the job market is exacerbating pressure on lower-income workers.

Three threats that spurred recession fears earlier this year have not yet panned out: crypto, regional banks, and headline layoffs in technology. The collapse of FTX and the troubles across all manner of digital currencies have hurt investors but not taken a meaningful number of jobs, and the failure and takeover of three regional banks has not dented the exuberance of the stock market and the economic forecasters. The job cuts that made headlines at highly visible technology firms were large at the firm level, but small at the industry level, and the job-cutting was contained to technology.

So as recession fears fade, what does it mean for short interest rates, for long rates, and for the stock market? Longer term, the Fed telegraphs 2.5% as the anchor for the Federal Funds rate, but we may see 5%-5.5% for the next 18 months. The broad U.S. stock market (Russell 3000) dropped 24.6% in the first three quarters of 2022, but the index is up 24.5% in the three quarters through June 2023, and the total return since December 2021 is -3%. The backstory is that these gains came from just seven stocks; the rest of the stock market has been flat. Market expectations for stocks exclusive of these hot dots is subdued.

The risk of recession has not gone away, but the onset may have been delayed. One important economic rule of thumb to remember is that it takes about a year for a change in interest rates to work its way through the economy. The Fed started raising rates in March 2022, and has continued into 2023. We may be a year from seeing the full effect of higher rates on the economy.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.