Listen to This Blog Post

Endowments are the financial backbone of many nonprofit organizations, providing a stable funding source to support mission-driven programs. The challenge for fiduciaries determining a spending policy is to balance the need for current outlays with the obligation to preserve purchasing power for future generations, a concept known as intergenerational equity. Spending too aggressively risks eroding the corpus and undermining long-term sustainability; spending too conservatively may compromise the ability to meet today’s urgent needs.

Endowment Spending Policies: Time for a Look

Against a backdrop of heightened policy scrutiny, shifting demographics, and pressure to reassess liquidity, many institutions are reevaluating their asset allocations to make sure they can meet their investment return targets. We also recommend fiduciaries review the fund’s spending policy in light of this challenging environment. In this blog we use Callan’s proprietary AssetMax simulation platform to evaluate how various spending policies influence the required return needed to meet spending goals while preserving purchasing power.

Understanding Spending Policies and Required Returns

A spending policy defines the methodology for determining annual withdrawals from an endowment. Common approaches include a fixed percentage of portfolio value at year end, a spending percentage applied to smoothed market values such as multi-year rolling averages, and inflation-based spending.

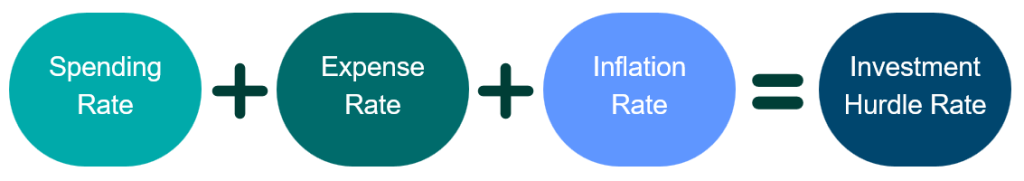

When evaluating the sustainability of a spending policy, fiduciaries must consider the required return necessary to preserve purchasing power over time. In this context, the required return (sometimes referred to as the hurdle rate) is the minimum return an endowment must earn to maintain its spending policy while achieving intergenerational equity. In the simplest terms, the hurdle rate is represented by the following formula:

However, different spending policies imply distinct hurdle rates because the spending rate is applied to a different measure (e.g., the market value at a point in time, a rolling average market value, or inflation). The spending policy and associated return requirement then informs portfolio risk tolerance and liquidity needs. Understanding how spending policy design affects the required return is foundational to achieving balance between short-term support for programs and long-term corpus preservation.

Simulation Approach and Results

We used Callan’s AssetMax simulation engine to evaluate long-run outcomes under three common spending policies:

- Simple Spending: 5% of the prior year’s market value

- Smooth Spending: 5% of the rolling three-year average market value

- Inflation-Based Spending: 5% of the initial market value, then growing with the rate of inflation

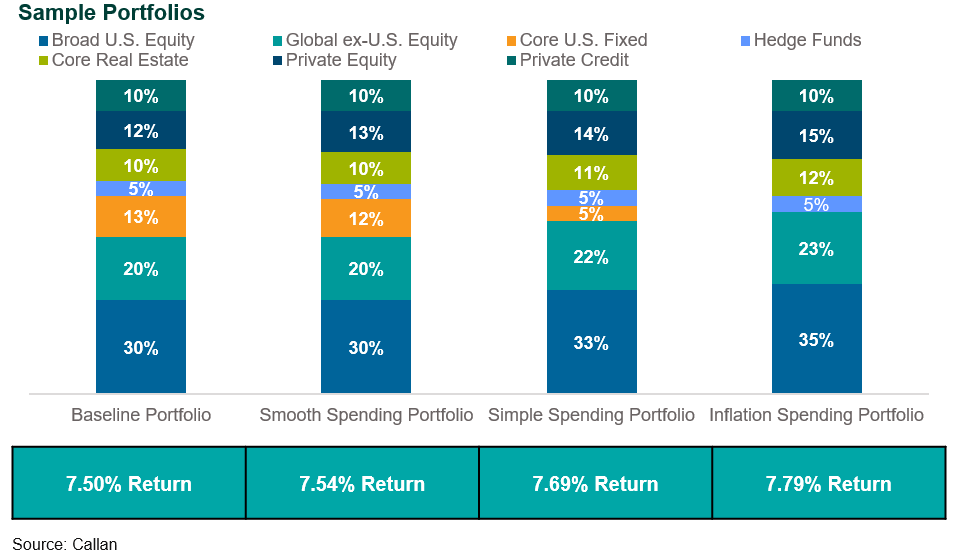

Simulations were run over a 10-year horizon using Callan’s 2025-34 Capital Markets Assumptions. Our inflation assumption is 2.5% (with a standard deviation of 1.6%). With 5% spending and 2.5% inflation, this implies a 7.5% required return if there was no variability in returns or inflation. By modeling a distribution of outcomes across thousands of scenarios, we were able to test the actual hurdle rate once uncertainty is factored in. We defined the hurdle rate as the return that maintains the real value of the portfolio in the median outcome after accounting for spending. For simplicity we assumed no contributions into the funds and no expenses. The simulated hurdle rate for each spending policy and a sample portfolio achieving that return is shown in the following chart.

The smooth spending policy comes closest to the 7.5% hurdle rate determined by the basic formula we laid out. However, a small amount of additional return is required to overcome market volatility even when the spending rate is smoothed over three-year average market values. This is because assets can perform worse than expected and inflation can also come in higher than expected, but you can’t retroactively adjust spending that has already been withdrawn from the corpus.

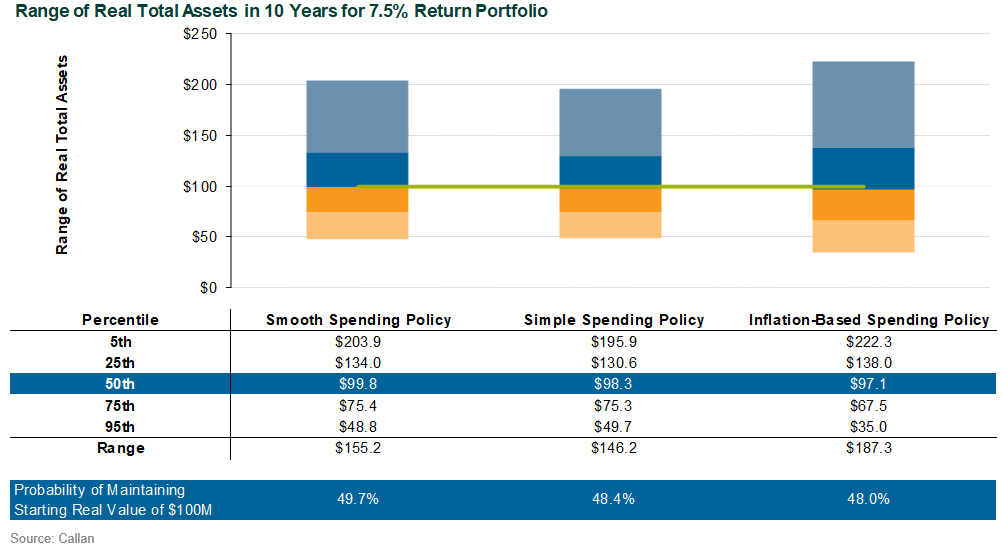

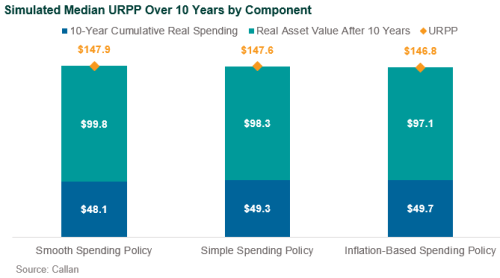

To illustrate how spending policy affects the hurdle rate, we can look at the range of outcomes for total real assets (the inflation-adjusted market value) over a 10-year horizon under different spending policies. We do this for a hypothetical fund that starts with $100 million in assets and we use the Baseline Portfolio that achieves 7.5% to make the comparison across spending policies easier.

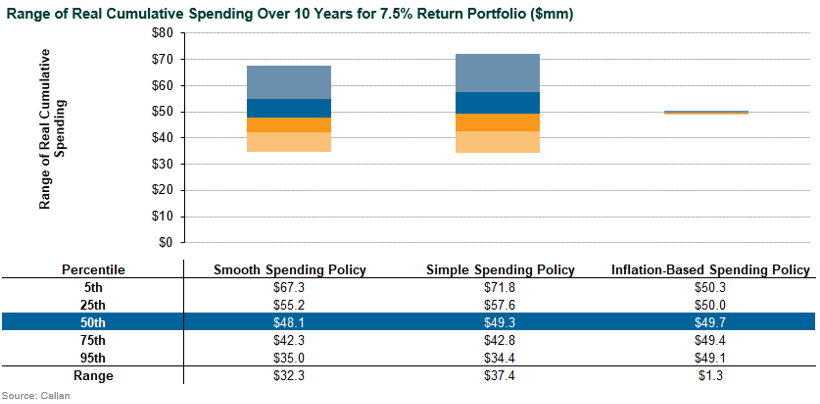

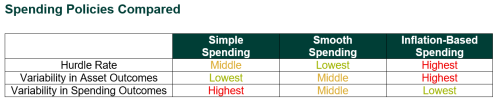

Notice the Smooth Spending Policy allows a portfolio earning 7.5% to nearly hold the real asset value steady at $100 million after 10 years of investing and spending. The other policies fall short of maintaining intergenerational equity, which is why portfolios need to generate higher returns under those spending policies. Another interesting point from the simulations is the range of potential outcomes based on different spending approaches. The Simple Spending Policy is most adaptive to the market value, changing the amount of spending based on the value of assets at the end of each year. That translates to lower variability in asset outcomes but the widest variability in spending outcomes. In contrast, the Inflation-Based Spending Policy has the widest range of asset outcomes but the lowest variability in spending (almost none).

It is also interesting to look at how the different policies deliver ultimate real purchasing power (URPP): the combination of real spending over 10 years plus the real value of assets remaining after 10 years. For example, because the Inflation-Based Spending Policy does not adjust for difficult market environments (since none of the spending is tied to market value), that policy naturally favors current spending over maintaining the real value of assets. For a university endowment, for example, that means favoring current students over future students and it also means less URPP generated overall.

Implications for Asset Owners

Alternative spending policies were developed many years ago to give endowment fiduciaries the flexibility to balance current spending needs with intergenerational equity. As endowments face renewed scrutiny—from potential policy changes to demographic headwinds—many are searching for ways to increase investment returns. In response, they are reevaluating asset allocation and looking at opportunistic investments with higher return potential. Investment committees should also revisit their spending policies, not just their asset allocations, to ensure alignment with long-term goals. As we showed, the spending policy might be making the assets work harder than intended.

Former Callan interns Lauren Avila and Roshni Sen contributed to this blog post.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.