Risk assets extended their gains from March lows with a strong quarterly finish for 2020. Pfizer’s Nov. 9 announcement of positive vaccine trial results, as well as Joseph Biden’s election on the promise of even more fiscal stimulus, solidified investor confidence in both equity and credit markets. The S&P 500 Index rallied 12.1%, while the Bloomberg High Yield Corporate Bond Index gained 6.5%. Jumping 19.7% in 4Q20, the BofAML All U.S. Convertibles Index capped its best three-quarter run ever (+69.3%).

Amid this bullish sentiment, investors reconsidered economic risks in the current K-styled recovery, where less fortunate sectors continued to suffer under the pandemic lockdown while others thrived. Hopes of immunized populations restoring economic activity back to normal revitalized stocks in those forsaken sectors, initiating a seismic lurch from growth to value in 4Q. Also previously restrained by COVID-19 lockdown effects, small cap stocks in the Russell 2000 (+31.4%) sprang to their feet, as if to say they weren’t dead yet either.

Wrestling with emerging fears of inflation, Treasury yields backed up modestly, as the U.S. dollar weakened and marginal risk capital shifted to emerging markets. The Bloomberg Commodity Index (+10.2%) benefited from the reflation theme, while the S&P GSCI Gold Index (0.0%) paused after eight consecutive quarters of gains.

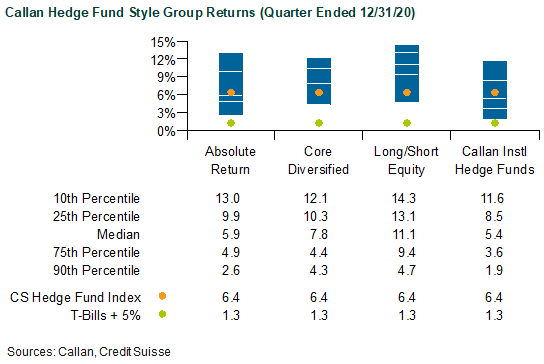

The vigorous but volatile market conditions fed by continuing central bank liquidity enabled healthy hedge fund profits from both alpha and beta. As a proxy for asset-weighted hedge fund performance, the Credit Suisse Hedge Fund Index (CS HFI) surged 6.4% in 4Q20, its strongest quarterly gain since 2009. Representing actual hedge fund portfolios net of all fees and expenses, the median manager in the Callan Hedge Fund-of-Funds (FOF) Peer Group advanced 8.5%.

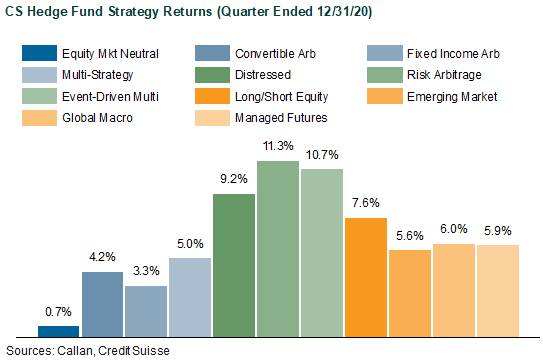

All strategies within the CS HFI were positive. Frenzied corporate issuance, whether equity, credit, or blank checks in the form of special purpose acquisition companies (SPACs), particularly enriched Risk Arbitrage (+11.3%) and Event-Driven Multi-Strategy (+10.7%). Revived hopes for downtrodden credits benefited Distressed (+9.2%), marking the strategy’s best quarterly gain since its 1994 inception. Riding the equity wave higher with an average 0.5 beta exposure, Long-Short Equity added 7.6%.

Within Callan’s Hedge FOF Peer Group, market exposures differentiated performance in the quarter. Fed by the equity rally as well as stock dispersion within it, the median Callan Long/Short Equity FOF (+11.1%) easily beat the Callan Absolute Return FOF (+5.9%), which benefited from tightening spreads in equity, credit, and event arbitrage. With diversifying exposures to both non-directional and directional styles, the Core Diversified FOF gained 7.8%.

Tracking 50 large, broadly diversified hedge funds with low-beta exposure to equity markets, the median manager in the Callan Institutional Hedge Fund (CIHF) Peer Group gained 5.4% in 4Q. For the year, the median manager was up 6.8%. The average fund focused on hedged credit led others focused more on equities, rates, and cross-asset strategies in the quarter, but lagged those other funds for the full year. Since many of the CIHF constituents are held within Absolute Return FOFs and, to a lesser degree, Core Diversified FOFs, their average performance serves as another benchmark to hedge fund portfolios pursuing mandates to diversify a traditional 60/40 mix.

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

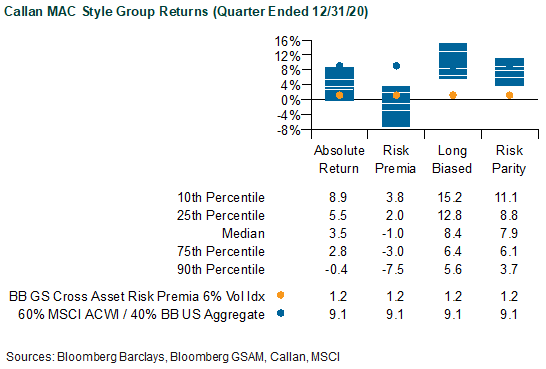

Measuring the performance of these alternative risk premia in the quarter, the Bloomberg GSAM Risk Premia Index gained 1.2% based upon a 6% volatility target. Within the underlying styles of the Index’s alternative risk premia, Currency Carry (+3.7%), U.S. Equity Value (+3.6%), and Currency Trend (+3.6%) were the big beneficiaries of the quarter’s cyclical risk-on rotation. The Index’s weakest factor was U.S. Equity Low Risk (-2.4%). For the full year 2020, Equity Value still bears a massive 20.0% loss while Equity Low-Risk fell 8.9% as the next worse detractor.

Within Callan’s database of liquid alternative solutions, the median managers of Callan Multi-Asset Class (MAC) style groups generated positive returns, gross of fees, consistent with their underlying risk exposures. For example, the Callan Risk Parity MAC, which typically targets equal risk-weighted allocations across asset classes with leverage, gained 7.9%, slightly trailing the more equity risk-oriented benchmark of 60% MSCI ACWI and 40% Bloomberg Barclays US Aggregate Bond Index (+9.1%). Given its usually long equity bias within a dynamic asset allocation framework, the Callan Long-Biased MAC (+8.4%) also marginally underperformed the 60%/40% index. The median Callan Risk Premia MAC fell 1.0%, reflecting its levered exposures to uncorrelated alternative risk premia (such as those in the Bloomberg GSAM Risk Premia Index). As the most conservative MAC style focused on non-directional strategies of long and short asset class exposures, the Callan Absolute Return MAC earned 3.5%.

Traditional markets of stocks and bonds have pulled forward returns from the distant future, given interest rates pressed to zero by central banks. These liquidity-driven markets facing economic uncertainty have created above-average market volatility, heated corporate activity, and amplified trading volumes. Consequently, diversifying strategies, whether hedge funds or alternative beta strategies focused on generating profits not tied to stock or bond betas, can offer a more rewarding return profile than had been the case in prior years with less stressed markets.