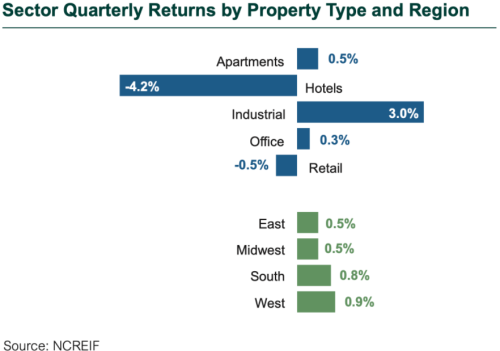

All sectors saw negative appreciation

- Pandemic’s impact reflected in 3Q20 results

- Income remained positive except in Hotel sector.

- All sectors experienced negative appreciation; Industrial remained the best performer.

- Dispersion of returns by manager within the ODCE Index due to both composition of underlying portfolios and valuation methodologies/approach

- Negative appreciation returns expected for 4Q and beyond

U.S. real estate fundamentals

- Vacancy rates for all property types are increasing or will likely increase.

- Net operating income has declined as retail continues to suffer.

- 3Q rent collections showed relatively stable income throughout the quarter in the Industrial, Apartment, and Office sectors. The Retail sector remained challenged, with regional malls impacted most heavily.

- Class A/B urban apartments’ rent collections have been relatively strong but vacancies have increased.

- Construction projects are increasing depending on municipality openings; existing projects have continued as material has become available.

- Transaction volume dropped off during the quarter with the exception of industrial assets with strong-credit tenants trading at pre-COVID-19 levels.

- Cap rates remained steady during the quarter. The spread between cap rates and 10-year Treasuries is relatively high, leading some market participants to speculate that cap rates will not adjust much. Price discovery is happening and there are limited transactions.

Global REITs rose but lagged the equity market recovery

- Global REITs underperformed in 3Q20, gaining 2.1% compared to 7.9% for global equities (MSCI World).

- U.S. REITs rose 1.4% in 3Q20, lagging the S&P 500 Index, which jumped 8.9%.

- Globally, REITs except in the U.S. and Singapore are trading at a discount to net asset value. In some regions the discount is at a five-year high.

- Property sectors are mixed, between trading at a discount or premium.

Real estate investment opportunities

- Primary opportunity: purchase of mispriced publicly traded real estate, both equity and debt

- Emerging opportunity: purchase of mezzanine loans from forced sellers

- Industrial development can be implemented by well-capitalized owners that do not need a construction loan.

- Low LTV loans on core properties

- Distress, take-privates, rescue capital, recapitalizations, value add re-leasing strategies, and lending strategies will move into the opportunity set for investment as the pandemic and social distancing continue and operating income is squeezed by tenants not paying rent.

- If core open end real estate funds are on the sidelines due to redemption queues, there may be more opportunities to buy core assets with less competition or to buy assets from the funds themselves.

- Industrial has been the one bright spot, as e-commerce take up has accelerated.

Infrastructure opportunities

- Strong performance from communications assets has drawn interest from infrastructure investors across the sector, and in some cases from real estate investors for data centers.

- Pandemic could accelerate the purchase of assets or formation of PPPs from cash-strapped governments/municipalities.

- Potential purchase of mispriced publicly traded infrastructure

- Some sellers looking to secure strong pricing for stable assets with steady cash flows

- Opportunity for purchase of assets from over-leveraged buyers and/or with GDP-linked revenue

Timberland and farmland opportunities

- Investment in farmland may increase if it proves to be a true diversifier in the pandemic.

- Volatility in commodity prices and changing supply chains may provide buying opportunities from overleveraged farmers and those who cannot shift crops away from restaurant/institutional use to grocery stores and suppliers to individual consumers.

- Institutional investment in timber has been waning for several years. The pandemic is unlikely to turn that tide.