With Fed rate hikes, skyrocketing prices, and a Nasdaq selloff, venture capital (VC) limited partners have no shortage of worries. The unicorn stampede of the past decade has begun to fade, with many technology companies drastically declining in value in the public markets. By understanding venture capital’s relationship with interest rates, inflation, and the public markets, institutional investors can better navigate the effect on their portfolios in 2022 and beyond.

Impact of the Public Markets Downturn on VC Investors

In marked contrast to the technology boom of the last few years, 2022 has been a tough year for high-profile unicorns and their recent initial public offerings (IPOs): Robinhood is down 55%, Doordash 56%, and Roblox 67% year-to-date through June 30. And many newly public technology companies, including these three, have traded significantly below their IPO price in 2022.

Such sharp declines have left institutional investors questioning how their VC portfolios will fare in this environment. Venture capital valuations do not typically drop as sharply as their public markets counterparts during a downturn. Venture-backed companies are typically valued based on their last financing round, even if it occurred multiple quarters ago. Although valuations may be adjusted based on operating performance or market conditions, those adjustments are not typically made immediately, especially for companies that recently raised capital. This leads to a smoothing effect in venture capital valuations, and ultimately returns, where changes in value are much more muted compared to publicly traded peers. Late-stage companies are often the first to be impacted by public markets volatility, as they are closest to a potential public listing and are more likely to use public markets comparables to inform their valuations.

The smoothing phenomenon in short-term venture capital performance can introduce the “denominator effect” to many institutional investors’ portfolios. When public equity allocations drop sharply and significantly (pulling down the denominator), but venture capital allocations do not drop as far (the numerator), venture capital and private markets more broadly become a larger percentage of a total portfolio. Investors are unable to rebalance these illiquid exposures, leaving them overallocated to private markets.

Going into 2022, many VC startups were flush with cash from last year’s prolific fundraising environment, providing them with a cushion during periods of volatility. Additional cash on the balance sheet enables startups to delay their next financing round and avoid a potential mark-down in valuation, known as a “down round,” which is typically a negative signal to investors about a company’s prospects and can make it harder for the startup to raise capital in the future.

Eventually, though, many startups will need to raise additional funds. Some venture-backed companies may consider alternative sources of capital, like venture debt or structured equity investments, as a means of avoiding a drop in valuation as well as further dilution of their common equity. Tapping these alternative capital sources can slow down the pace of financing rounds, which can then slow the pace of capital deployment by VC funds, particularly compared to the frenzy of 2021.

Should the downturn become prolonged, venture capital funds may become more careful about where they invest, particularly in later-stage financing rounds. This caution may result in a flight to quality, with a shift away from revenue growth at any cost toward profitability and sustainable growth. Some late-stage companies may successfully navigate this shift by reducing their cash burn rates (the rate at which they are losing money) and moving their business models toward profitability, although this may come at the expense of revenue growth. As a result, the sky-high revenue multiples of the past may come down, and certain businesses may transition their valuation multiple from a revenue basis to an EBITDA basis (using Enterprise Value (EV)/EBITDA, as opposed to EV/Revenue). Late-stage companies that are unable to make this shift may encounter near-term challenges in raising additional capital, particularly from more risk-averse investors.

A market downturn often closes the IPO window for late-stage companies, which can delay upcoming exits. Many pre-IPO companies would prefer to wait for a more optimal exit environment, even if that means longer holding periods for their investors. VC funds must balance the timing of their exits with the impact of longer holding periods, which can drag down IRRs. A slower IPO environment can also prompt alternative exit routes for some companies, which may now consider a strategic or financial acquisition as a more attractive option. Although these M&A exits provide greater certainty and a faster timeline, they often come with lower returns than an IPO.

Insights from the Dot-Com Bubble

To provide some perspective on the severity of today’s market volatility, let’s take a look at the Dot-Com Bubble of 2000-02. Similar to 2000, the markets over the last few years experienced a large run-up in technology stocks and venture capital investing fueled by low interest rates and an emphasis on revenue growth over profitability. During the Dot-Com Bubble, the Nasdaq Composite Index, which is heavily weighted toward technology companies, peaked in March 2000 after more than doubling over the prior year. It experienced a prolonged downturn, not reaching its trough until 2002. Today’s tech bubble saw the Nasdaq peak in November 2021, but with a much more moderate run-up. It has subsequently dropped by 31% as of 2Q22, similar to the Nasdaq’s decline in 2000 over a comparable timeframe. Even though the recent technology boom was not as exuberant as the 1990s, the sharpness of today’s drop in value (so far) is similar. What remains unclear is whether the downturn today will last as long as it did during the Dot-Com Bubble—and when the trough will occur.

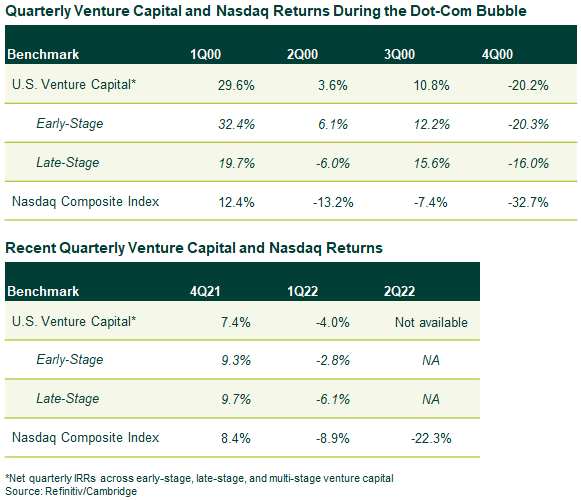

In 2000, the downturn in the public markets had a muted and delayed effect on venture capital performance. As shown in the table below, the public markets saw declines starting in 2Q00, while venture capital did not fall significantly until 4Q00. This year, venture capital returns followed the public markets much more closely in 1Q22, although they did not decline as sharply. As expected, late-stage venture capital was impacted more severely than early-stage. While the Nasdaq did not fall as far in 1Q22 as it did in 2Q00, late-stage venture capital fell by about the same amount (roughly -6%), suggesting closer ties between late-stage venture-backed companies and the public markets today, as well as large exposures of post-IPO public equity in many late-stage funds. Early-stage funds were also quicker to mark down their investments this year, possibly in part due to post-IPO public equity holdings. Although venture capital returns are still smoothed in 1Q22 with less severe declines in valuations, the downturn in the public markets today had a more immediate impact on venture capital performance than in the past. Although 2Q22 venture capital returns are not yet available, they will be even more telling as to the full impact of the public markets downturn on venture capital.

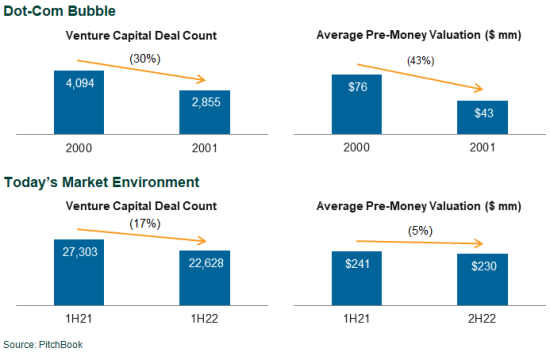

In looking at year-over-year trends in VC activity, deal flow and valuations today have not been singed as severely as in the aftermath of the Dot-Com Bubble. According to PitchBook, venture capital deal count dropped by 30% from 2000 to 2001, while valuations dropped by 43%. Today, deal count has only dropped by 17% from 1H21 to 1H22. Venture capital valuations have fallen by a modest 5%, but the impact varies by stage, with late-stage valuations dropping by 14% and early-stage valuations actually jumping by 67%. Although the pace of new investment has slowed this year, financing rounds are still occurring and valuations have yet to be impacted uniformly. As more companies seek to raise additional capital in the second half of the year, valuations as well as the pace of financing rounds may see further declines.

Inflation Cuts into VC Growth

High inflation hits startups particularly hard, since they are typically unprofitable and rely on external capital to fuel their growth. Rising costs increase a startup’s cash burn rate, shortening its cash runway (the amount of time until its cash runs out). Higher costs cut into the company’s margins and require more cash on the balance sheet to grow at the same pace. While some companies may be able to pass these costs on to their customers, inflation nevertheless increases a startup’s capital needs and potentially slows down its growth rate.

High inflation can also cause enterprise and consumer spending to decline, which can affect the revenues of VC companies. Within software in particular, many startups use subscription-based business models that emphasize recurring revenue. These subscription or “software as a service” (SaaS) models have been touted for their sticky customer revenue, offering purportedly “mission-critical” products and services. Today’s inflationary environment may test these strong retention rates when contracts come up for renewal. While some companies’ revenues may prove to be resilient in this environment, others may encounter challenges in customer retention.

Venture Capital Less Attractive in High Interest Rate Environment

Unlike leveraged buyouts, which will see increased borrowing costs and a likely corresponding decrease in valuations, rising interest rates have minimal immediate impact on unlevered companies, including venture-backed companies. However, higher interest rates increase the discount rate used in discounted cash-flow valuation models, thereby reducing the entry valuation needed to achieve the same returns. A volatile economic environment may make VC funds take a more conservative approach to their underwriting models and incorporate multiple recessionary scenarios. In making new investments, they may prefer companies that are closer to profitability with less uncertainty about the scalability of product revenue and the size of addressable markets.

As interest rates continue to rise, venture capital may appear less attractive to institutional investors on a risk/return basis, compared to yield-oriented asset classes. Low interest rates reduce the opportunity cost of investing in illiquid assets that do not distribute steady cash back to investors; however, that opportunity cost increases along with interest rates. If rates continue to rise and remain elevated, some investors may seek to rebalance their portfolios away from high-risk, illiquid strategies.

Key Takeaways for Institutional Investors

Volatility in the public markets does not typically impact venture capital valuations to the same degree—and neither does inflation or interest rates. Investors may see the impact first in their late-stage venture capital holdings, before it trickles down to early-stage venture capital and other areas of private equity. Each consideration impacts venture capital differently, as reviewed below:

- Public Markets Volatility can impact returns by pausing venture-backed exits, pulling down public markets comps used to inform late-stage valuations, and slowing the pace of capital deployment. As a result, the IRRs of recent vintage years may be significantly impacted by the market downturn of 2022.

- Inflation makes it more difficult for venture capital startups to continue growing rapidly, by increasing their costs and testing the stickiness of their customer bases. High inflation may ultimately impact VC returns by lengthening the growth timeline for startups and increasing the capital needs of venture-backed companies.

- High Interest Rates may make venture capital appear less attractive from a risk/return perspective compared to lower risk asset classes. It also increases the opportunity cost of venture capital compared to yield-oriented investments. As interest rates continue to rise, investors may reevaluate the size of their VC portfolios, to ensure they are still comfortable with the asset class’ risk/reward trade-off.

The impact of rising interest rates, high inflation, and public markets volatility on venture capital is often delayed and muted compared to public equity strategies, creating a smoothing effect on venture capital performance. As a result, investors this year may be confronted with the “denominator effect” and the resulting overallocation to venture capital and other illiquid asset classes. Given that rebalancing in private markets is challenging, some investors may need to pause future commitments or look to the secondary market as a way to reduce their allocations. By understanding the relationships between venture capital and the public markets, inflation, and interest rates, investors can make more informed decisions about how to best position their portfolios in 2022 and beyond.