Listen to This Blog Post

Systematic investment managers, those that primarily use a mathematical process rather than human judgment to select investments, have seen a surge in popularity in recent years. Looking across 10 systematic-only investment managers, their total assets under management grew approximately 30% between 2022 and 2024.

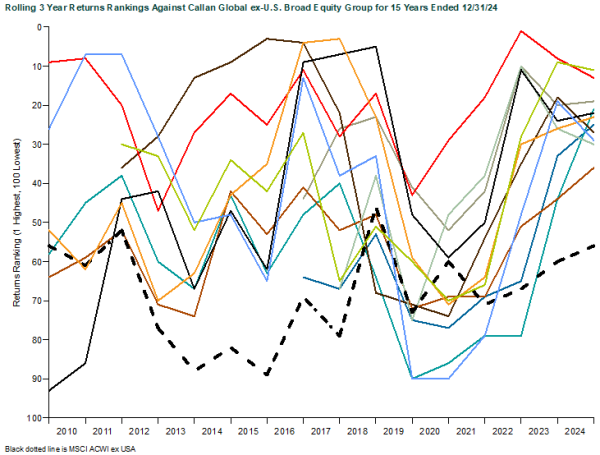

And while it’s not clear whether this increased attention is driven by a broader appreciation of new quantitative tools (e.g., alternative data and AI), overall, global ex-U.S. systematic managers have been doing exceptionally well. Ranking the trailing 3-year returns for 11 core focused systematic MSCI ACWI ex-USA investment products against the Callan Non-US All Country Broad Equity universe, there is a clear jump in performance in 2023-24, with the worst returns being in the 36th percentile, and 7 managers in the top quartile. This level of similar performance is unusual, as no comparable high returns have existed over the last 15 years.

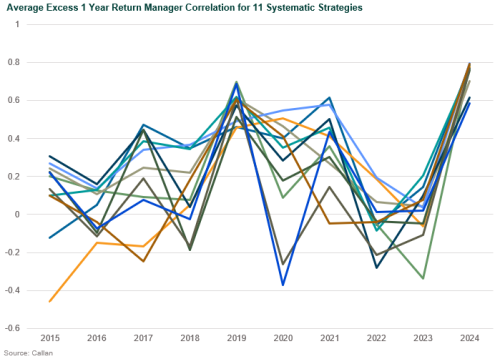

Taking the same managers and comparing their average correlation of returns, we can see that this is a very unusual situation. Historically, the managers’ returns have been relatively uncorrelated, except in 2019 (when most managers struggled). In 2024, the manager’s average correlation was 0.74, the highest level in the last decade.

This is especially surprising as many managers have touted their increased use of alternative data sets, natural language processing, and increased computing power to build more dynamic models. As managers incorporated more data and alternative approaches, we would have expected to see a divergence in performance.

This leads us to believe that the recent success of systematic managers may not be entirely attributed to model developments, but rather to current market conditions, which have favored value, a factor that many systematic managers have incorporated into their processes. Momentum, another factor, was very positive in 2024, but lagged in 2022 and 2023, and does not help explain the returns (the MSCI ACWI ex-USA Momentum Tilt beat the core benchmark by 5.1% in 2024, while it trailed by -0.9% in 2023 and -1.1% in 2022).

There is no obvious reason why systematic managers have been showing strong returns, but we would caution investors against accepting recent performance as evidence of a quant’s capabilities. As markets evolve, so too will the opportunities, and we believe the firms that invest in the rigor of their models and the sophistication of their techniques will be the ones to capture the next wave of systematic returns. The dispersion is coming. The question is: who will be ready for it?

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.