Real Estate Performance: Strongest gains for ODCE in history

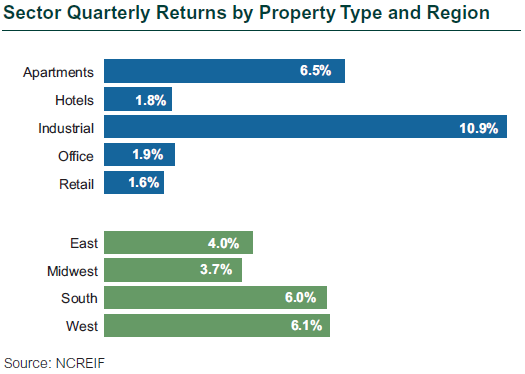

- The NFI-ODCE Index posted its best return ever in 3Q21; Industrial was the top performer.

- Income returns were positive except for the Hotel and Retail sectors.

- Appraisers are pricing in a recovery due to strong fundamentals in Industrial and Multifamily.

- Return dispersion by manager within the ODCE Index was due to the composition of underlying portfolios.

Compression in vacancy rates

- Vacancy rates kept compressing in Industrial and Multifamily as demand continued.

- Net operating income remained negative for Retail but its recovery continued; pent-up demand is evident through foot traffic in retail centers.

- 3Q21 rent collections have stabilized across all sectors.

- Demand outpaced supply as new construction of preleased Industrial and Multifamily occurred.

Gains in transaction volume

- Transaction volume increased quarter over quarter led by Multifamily and Industrial assets with strong credit tenants, which are trading at higher values than pre-COVID-19 levels.

Global REITs trailed equities; U.S. REITs outperformed

- Global REITs underperformed in 3Q21, falling 0.9% compared to 0.0% for global equities (MSCI World).

- U.S. REITs rose 1.0% in 3Q21, beating the S&P 500 Index, which gained 0.6%.

- Global REITs were trading below NAV, except for those in Singapore, Japan, the United States, and Canada.

- Property sectors were mixed between trading at a discount or premium.

- Ongoing volatility in REIT share prices offers opportunities to purchase mispriced securities, individual assets from REIT owners, and discounted debt, as well as to lend to companies and/or execute take-privates of public companies.