The portfolios of insurance companies have been tested during this low-rate environment. They tend to be highly tilted toward fixed income due to regulatory and accounting considerations. Moreover, the high-quality nature of certain fixed income investments has generally served to produce reliable income and match liabilities. But now these companies are increasingly challenged to identify yield-enhancing strategies to produce incremental returns.

There is one potential solution to help insurance investors meet their return goals without disproportionately adding risk: investment-grade private placements. This strategy presents opportunities to increase portfolio yields with higher spreads compared to other types of fixed income for similar levels of required capital.

Private placements have been a part of insurance company fixed income portfolios for several decades. While predominantly used by life insurance companies due to their long investment horizons and ability to withstand more illiquidity, there has been an increase in interest from both health insurance providers and property and casualty insurers. There are many reasons for the growth in interest and use of private placements, and we highlight a few that may make private placements a suitable option for insurance company portfolios. When evaluating private placements, insurers must consider a number of dynamics that are unique to the regulatory environment in which they operate, including credit quality, time horizon, and loss experience.

Insurance investors must be mindful of maintaining a high-quality portfolio since non-investment-grade securities carry a higher capital charge for risk-based capital calculations. Importantly, public bonds and private placements face equal treatment, so there is no increase in risk capital when insurance investors shift from publics to privates. Private placements are available across the rating quality spectrum; however, approximately 75% of issuance is made on behalf of borrowers with credit quality between A- and BBB-.

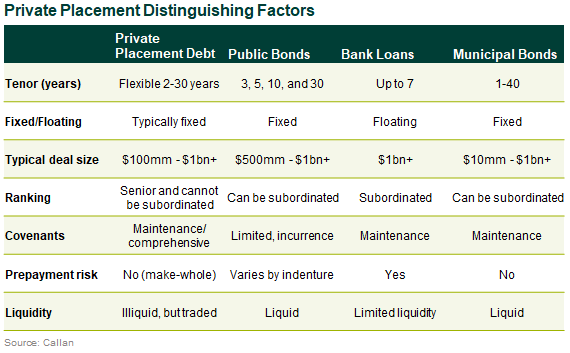

These securities are often bilaterally negotiated between the borrower and lender or syndicate of lenders. As such, several of the deal points are customizable, among them being the duration or tenor of the lending arrangement. Given the different duration of liabilities for many insurance investors, the ability to customize transactions to meet liabilities of varying horizons is attractive. Typically investment-grade public credit bonds are issued with standard tenors of 3, 5, 10, and 30 years; investment-grade private placements can be issued with tenors anywhere from 2 to 30 years. In return for accommodating the customized needs of particular borrowers, lenders have been able to extract a yield premium of roughly 100 basis points relative to comparably rated bonds in the public credit market.

The private nature of negotiating the lending agreement has resulted in a favorable credit-loss experience compared to public bonds. Much of the increased protection comes in the form of covenants structured into the lending agreement, which serve to maintain the lender’s senior position in the capital structure and to protect against defaults due to any financial action detrimental to the business or its cash flows. Having conservatively structured covenants can provide an early indication of potential deterioration to the borrower’s health and lead to a more proactive approach to resolving those issues. Another factor in reducing losses is the ability to participate actively in credit recovery strategies. With fewer counterparties involved in each transaction, each lender/participant can play a more active role in influencing a better outcome. These may involve a restructuring, a recapitalization, or a bankruptcy. Each of these strategies can produce a higher recovery rate that is otherwise not as easily achievable in the public markets.

This is a challenging time for producing yield for insurance assets, and at Callan, the focus of our research has been on seeking out ideas such as private placements to help insurance investors navigate this low interest rate environment. We focus on asset managers that have proven track records in investment-grade private placements, and we emphasize thorough diligence on fees and appropriate strategies to better position investors to experience the right outcome.