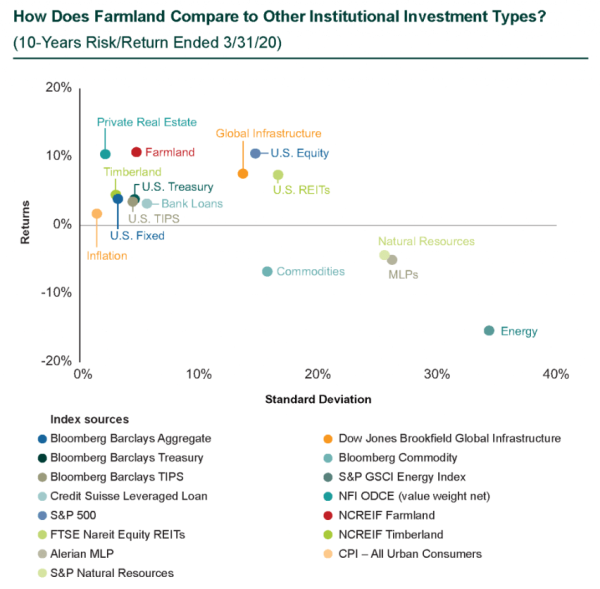

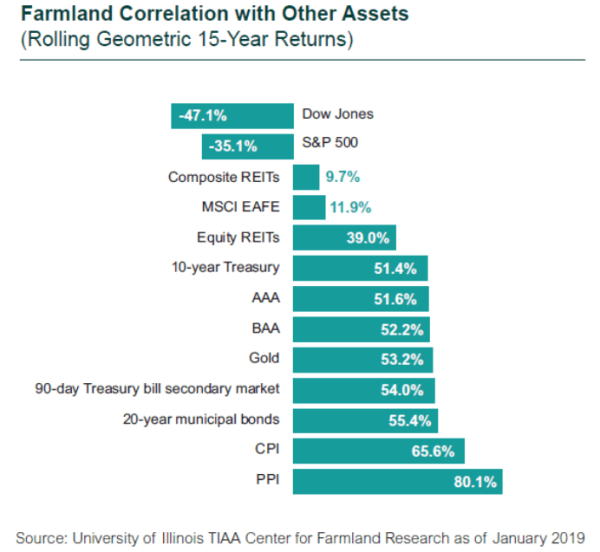

There may never be another global event akin to the COVID-19 pandemic in our lifetimes that more clearly tests the investment thesis for farmland as a component of a diversified institutional investment portfolio. Investors make strategic allocations to farmland for its diversification potential, low correlation to more traditional asset classes, and inflation-hedging properties. These benefits derive from the unique drivers of farmland: the need for food security, global population growth, and an emerging middle class with an increasing demand for animal protein, to name a few.

The pandemic has highlighted critical vulnerabilities in our food supply infrastructure. Many U.S. consumers have experienced significant disruptions getting their groceries as stores have struggled to keep shelves stocked under surging demand for essential items. Sales at grocery stores can be expected to stay at levels well in excess of historical norms for the foreseeable future, but demand from restaurants and other food service providers materially dropped as they closed or reduced operations, leading to disruptions in the associated supply chain. The loss of demand from food service providers leaves some agricultural producers in a difficult position. Because they cannot easily shift to distributing products into the retail supply chain as a result of labeling and packaging limitations, many farmers are saddled with excess inventory and are forced to dump fresh milk or leave fresh produce unharvested.

Prices for most staple commodities remain relatively stable, with the notable exception of corn prices, which have continued to decline following reduced demand at ethanol plants that consume about one-third of U.S. corn production.

Other dislocations have arisen at different rungs of the value chain as a result of the virus. Closures at meat processors, for instance, sent prices on products like ground beef surging on anticipation of a looming shortage. Additionally, the implementation of additional safety measures necessary to protect workers has, in some instances, reduced productivity.

It will take time to fully assess the impact of COVID-19 on the supply chain and the effectiveness of these protective measures.

The opportunity for farmland investment remains attractive, particularly within strategies focusing on asset-level value enhancements. Low commodity prices and rising input costs have been headwinds for farmers in recent years, limiting their ability to scale up operations or make farm-level improvements, thus providing opportunities for value-add investors. The upheaval in food consumption patterns, the supply chain, and associated infrastructure may also generate additional opportunities for patient investors.

Over the near term, Callan does not anticipate COVID-19 will impact farmland valuations. Cash rents for farmland assets are generally paid in one or two installments over the course of the year, with the first usually coming due around March 1. Many farmers had already paid their rent for the year before concerns over the coronavirus fully materialized in mid- to late March. Valuations over the long-term will depend on how a number of factors play out over the next several months; however, the asset class has historically held its value through periods of economic downturn or uncertainty.

As investors find a renewed interest in safe-haven investments in response to current market conditions, farmland is worth a closer look.