This blog post is one of a series excerpted from Aaron Quach’s white paper on rental housing, available at the link above. For other posts in the series, click here.

The vast majority of institutional real estate portfolios are invested in the rental housing sector in some form. The rental housing sector is unique in that it fulfills the basic human need for shelter and therefore benefits from a certain inelasticity of demand not found in most other property sectors.

The rental housing sector is comprised of several different housing types serving various segments of the market, including market-rate multi-family apartments, rent-regulated multi-family apartments (“affordable housing”), manufactured housing communities, single-family rental homes, student housing accommodations, and senior housing facilities.

This blog post will detail issues for institutional investors regarding multi-family apartments. Other blog posts will examine the additional sectors as well as implementation issues faced by all of the housing types categorized under the rental housing sector.

Multi-family apartments represent the most prominent sub-type within the rental housing market. The institutional market share for multi-family apartments in the U.S. stands at approximately 40%, according to Savills.

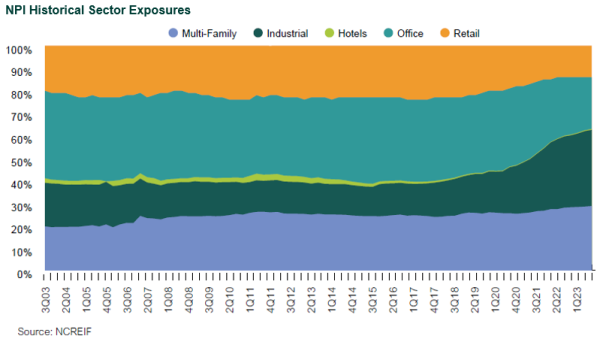

Multi-family apartments have represented a meaningful portion of institutional real estate portfolios for decades—an average of 24% of the National Council of Real Estate Investment Fiduciaries (NCREIF) Property Index over the past 20 years—and their position as a primary property type is expected to continue for the foreseeable future.

Institutional investors are drawn to the apartment sector for many reasons, including inelastic demand and inflation sensitivity, as well as broader demographic trends that have contributed to the sector’s consistent popularity.

The size of the prime apartment renter cohort—defined as those 20-34 years old—has gradually increased with the aging of the millennial generation, according to the U.S. Census Bureau, with the number projected to reach 68 million in 2035. The increasing cost of homeownership is expected to serve as a long-term tailwind for apartment demand, as many would-be homeowners are forced to remain renters for longer than previous generations. However, we have also observed a rise in “renters-by-choice,” as tenants who could afford to own their own homes increasingly prioritize flexibility to move and freedom from homeownership responsibilities such as property maintenance.

The Three Classes of Multi-Family Apartments

Within market-rate multi-family apartments, the universe is generally classified into three segments: Class A, B, or C:

- Class A apartments are considered the highest tier. They are relatively new (<10 years old) and feature modern designs; upscale finishes such as stainless-steel appliances, hardwood floors, and granite countertops; and a wide range of desirable amenities such as fitness centers, swimming pools, concierge services, and high-end appliances. Class A properties tend to target higher-income tenants that are renters by choice—as opposed to renters by necessity—and command higher rental rates. Institutional investors targeting Class A apartments can generally expect higher upfront acquisition costs but lower capital expenditures over time, due to the newer vintage of these assets.

- Class B apartments represent the middle tier in terms of quality and affordability. These are generally older (10-20 years) or less recently renovated compared to Class A properties. Class B properties may not offer the highest-tier amenities but still offer comfortable living conditions with adequate amenities such as parking, laundry facilities, and communal spaces. Class B properties typically attract a broader range of tenants, including middle-income households. Institutional investors often target Class B apartments for value-add strategies through renovations or improvements; however, these properties tend to require additional capital expenditures compared to Class A properties.

- Class C properties tend to be older buildings or properties that require significant renovations or maintenance. They often have more basic amenities and fewer modern features compared to Class A or Class B properties. These properties are generally more affordable and cater to lower-income tenants or those seeking more budget-friendly options. They are commonly located in less desirable neighborhoods or areas with lower rental demand. Class C properties may require more hands-on management and ongoing maintenance, but they can present opportunities for investors looking for value-add projects or cash flow generation.

Institutional investors seeking investment opportunities in multi-family apartments may consider dozens of seasoned investment managers with demonstrated track records across both closed-end and open-end vehicles and across the risk spectrum from core funds to opportunistic vehicles.

The open-end universe of dedicated multi-family funds includes over a dozen institutional-quality funds, while the closed-end universe is much larger, with scores of institutional managers sponsoring dedicated fund series focused on the property type. Investment strategies may vary based on asset quality, tenancy, geography, and risk profile.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.