For defined contribution (DC) plans, managing recordkeepers can be daunting. In the latest edition of the DC Observer, Callan’s Jamie McAllister and Jana Steele outline ways to make this vital oversight process easier.

One of the best ways to help monitor recordkeepers is by conducting periodic searches, which give plan sponsors the chance to survey the marketplace and make sure their recordkeeper is the right one. Callan recommends conducting a search at least every five to seven years.

Additionally, a comprehensive fee benchmarking study should be conducted at least every three years, with annual checkups in between. Such a study focuses on the revenue the vendor collects to administer the plan and reviews that against comparable bids the plan sponsor could receive.

The first critical step for an effective search is to create a project plan with sufficient time for a successful conversion. The process should identify relevant parties, establish roles, set milestones, and get consensus on the project’s goals.

The next step is to gather data. While it is important to collect all the necessary documentation and participant/plan information, it is just as important to understand where the plan is headed. For example, are there going to be significant changes to the fund lineup, such as adding white label funds? It is critical to include recordkeepers with the right capabilities that can also grow with the plan.

Identifying the challenges of the current plan and exploring how it could be improved is another important step. The plan sponsor can then assess how other recordkeepers might handle a problem while also compelling the incumbent recordkeeper to take a fresh look at the plan.

Understanding the plan’s status, needs, and goals helps identify the best recordkeeper candidates. Selecting the bidders involves both quantitative screening and a qualitative assessment of the providers, and the sponsor should distinguish between essential and “nice-to-have” features.

Once the information is gathered, the RFP drafting process can begin. The RFP should provide all the necessary background and plan information. It should also include both general “nuts and bolts” questions to make sure the recordkeeper has the necessary capabilities as well as questions tailored to the plan (e.g., conversion timeline, proposed team, fees, etc.).

Callan generally recommends giving at least three weeks for the vendors to respond to the RFP, particularly for larger, more complex plans.

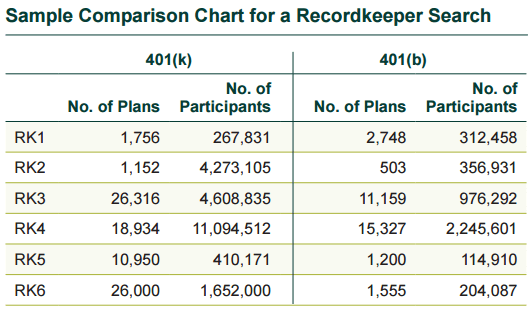

Analyzing the bidders and selecting the finalists come next. When doing the analysis, we recommend comparing the providers’ documentation in a side-by-side format.

Finalists will be determined based on the analysis and scoring. The scoring weights established while drafting the RFP may highlight variations in the responses and further document the rationale for selecting finalists. Reference checks should also be conducted for the finalists, using the same questions for each one.

Callan believes that conducting both finalist presentations and on-site visits are essential. This provides the chance to meet with both senior management and the day-to-day contacts.

Next, the sponsor will select a finalist and notification, negotiation, and contracting can begin. The final and critical step in the search is to issue a report summarizing the findings and documenting the process, analysis, and outcomes.

A successful recordkeeper search provides the plan sponsor with the opportunity to confirm their recordkeeper has the right services, team, and capabilities. The search process may also lead to lower fees, revisions to the fee structure, or changes to the handling of excess revenue. And, if a search does lead to the selection of a new vendor, the conversion process managed by a competent vendor in collaboration with the plan sponsor can be seamless and painless to the plan sponsor and participants.

A successful recordkeeper search provides the plan sponsor with the opportunity to confirm their recordkeeper has the right services, team, and capabilities.