Lori Lucas, CFA, and James Veneruso, CFA, CAIA, recently attended the annual Defined Contribution Institutional Investment Association (DCIIA) Public Policy Forum in Washington, DC. Here are some notes and observations from the event. (Lori is the DCIIA Chair.)

The DCIIA Public Policy Forum “brings together industry leaders with policy makers and other thought leaders to discuss ways to improve the retirement security of American workers through the retirement savings system.” Given that the theme of the Forum is “public policy,” it’s not surprising that there were several speakers and topics from the public sector. Key themes included:

- Improving access and increasing savings: This panel featured Senator Kent Conrad, Former Senator from North Dakota and John Scott of the Pew Charitable Trusts. It explored demographics driving lack of worker coverage in retirement plans as well as initiatives to improve coverage described in the June 2016 “Securing Our Financial Future” report by the Bipartisan Policy Center’s Commission on Retirement Security and Personal Savings, of which Conrad is co-chair.

- Litigation: Certainly top-of-mind for many plan sponsors, this discussion focused on the recent spate of university lawsuits and proprietary fund lawsuits—pitting a plaintiff’s litigator against one that serves on the side of defendants. Both agreed, however, that it has become easier to reach the pleading stage and not dismiss cases before discovery.

- Fiduciary Rule: This session examined the history of the Fiduciary Rule and subsequent attempts to modify it. There was general agreement that the industry cannot walk back from “acting in people’s best interest.”

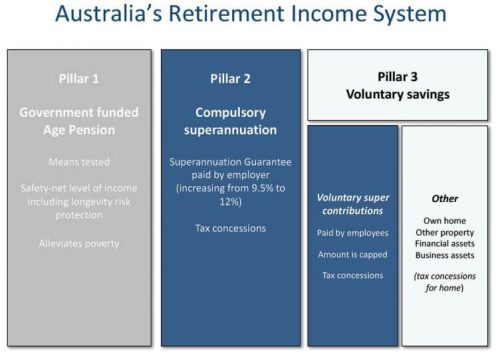

- Lessons from abroad: Attendees learned more about the Australian and U.K. retirement systems from Jenny Wilkinson of the Australia Treasury and Charlotte Clark, UK Department of Work & Pensions. Both the Australian and UK system are mandatory and feature auto-enrollment with default contribution rates of no less than 8%. The systems are well received by workers.

Upcoming DCIIA events include the 2017 Academic Forum, October 18-19 in New York, and the 2018 Investment Forum & Member Board Meeting, January 22-23 in Fort Lauderdale.