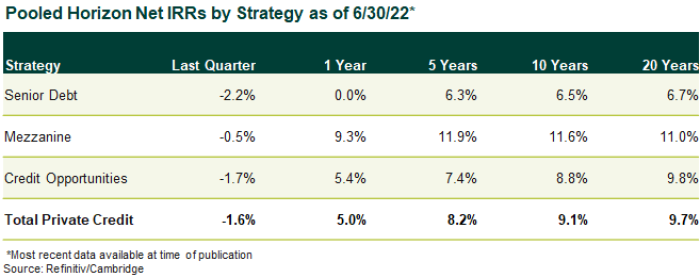

There is continued strong private credit demand in a rising rate environment, in which the returns of floating-rate loans are bolstered. Private credit performance varies across sub-asset class and underlying return drivers, but on average the asset class generated net IRRs of 8% – 10% for trailing periods ended June 30, 2022. Higher-risk strategies performed better than lower-risk strategies.

- During 3Q22, clients moved away from new allocations to traditional sponsor-backed direct lending due to the increased competition and commoditization within the space.

- Demand has continued to be robust for less-competitive areas of private credit with high barriers to entry and attractive risk/reward opportunities.

- Includes opportunistic lending, specialty finance, and industry or other niche-focused lending strategies such as venture debt and health care lending

- Limited partners (LPs) are seeking alternative structures designed to streamline the investment process while improving underlying liquidity. A number of general partners are launching evergreen structures as a response to LP interest.

- Going forward, Callan suggests revisiting the sponsor-backed middle-market direct lending opportunity as deal economics have become more attractive with demand for private loans somewhat bolstered by the unpredictability of execution in the public high yield and syndicated loan markets. Careful manager selection in this space will be important with a focus on strong sourcing, disciplined underwriting, and robust work-out capabilities.

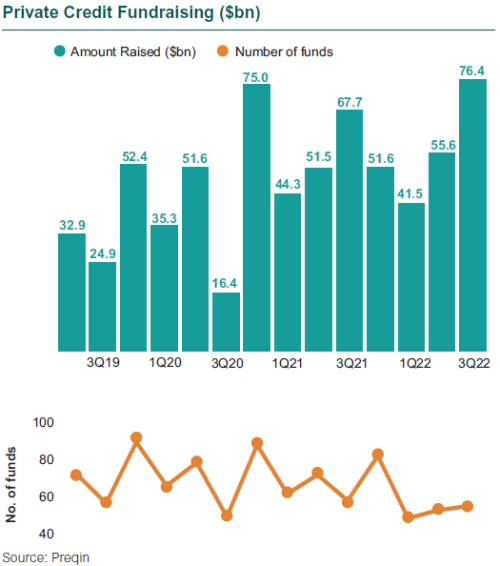

Private Credit Fundraising Increases YOY

- Private credit fundraising was robust leading into the COVID dislocation with a particular focus on direct lending, asset-based lending, and distressed strategies.

- Fundraising activity increased year-over-year, with $68 billion in capital raised in 3Q21 vs. $76 billion in 3Q22.

- The average fund size year-over-year increased from $1.4 billion in 3Q21 to $1.6 billion in 3Q22 as established managers grow fund sizes in response to strong LP demand.

- For mature private credit programs, demand is increasing for diversifying strategies like specialty finance and royalties’ strategies to capture opportunities outside of traditional sponsor-backed direct lending.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.