A variety of macro concerns led to a volatile 3Q21 for financial markets, as investors took chips off the table toward the end of September. China was the main culprit behind this market volatility, which started with a regulatory crackdown targeting the country’s internet giants and for-profit education companies. It was followed by the debt crisis of Chinese property developer Evergrande. Inflation fears returned throughout the quarter as commodity prices surged. The Delta variant weighed on consumer sentiment, while supply-chain problems continued to be an issue throughout the quarter. The Federal Reserve announced a plan to begin tapering bond purchases later in the year. Interest rates fell throughout most of the quarter but reversed course in late September, with the yield on the 10-year U.S. Treasury hitting 1.5%.

While global markets all suffered a late-quarter drawdown, the S&P 500 Index (+0.6%) managed to produce a positive quarterly result, as corporate earnings came in ahead of expectations. Cyclical stocks outside of financials struggled, led lower by metals and mining, while media, telecom, health care, and information technology all notched small gains. Growth outperformed value during the quarter as factor shifts continued to play a role in daily stock price action. The Bloomberg High Yield Index gained 0.8%, as U.S. credit markets remained resilient despite the potential default of Evergrande. The MSCI Emerging Markets Index lost 8.1%, driven by China, which suffered from negative investor sentiment throughout the quarter as the government advanced its “Common Prosperity” agenda.

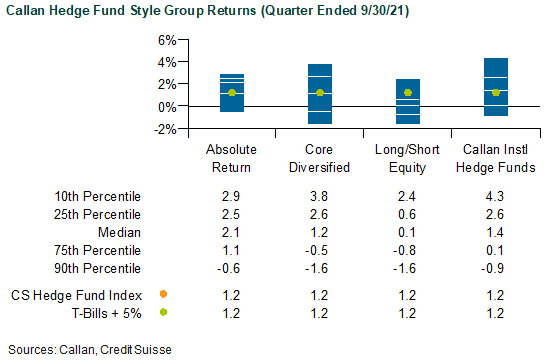

Hedge funds as a whole ended the quarter higher, driven by commodities-oriented relative value, event-driven, and sector-focused strategies, as well as macro managers with short positions in U.S. interest rates. Representing a raw collection of hedge funds reporting performance without implementation costs, the Credit Suisse Hedge Fund Index (CS HFI) gained 1.2% in 3Q. As an actual hedge fund portfolio net of all fees, the median manager in the Callan Hedge Fund-of-Funds (FOF) Peer Group added 0.9%.

Serving as a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, the median manager in the Callan Institutional Hedge Fund Peer Group added 1.4%. Within this style group of 50 members, the average Hedged Equity manager gained the most at 3.7%, driven by managers focused on tech/media/technology (TMT) and event-related deals. The weakest substyle, Hedged Rates, edged ahead only 0.02% as it navigated a bear flattening across the yield curves in the U.S., U.K., and Continental Europe. The average Hedged Credit manager added 1.2% but underperformed the broader peer group. Credit markets were mixed, on average, as both high yield bonds and leveraged loans generated performance during the quarter with little dispersion across ratings.

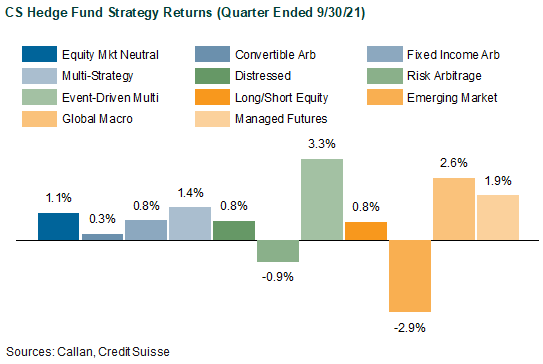

Within CS HFI, the best-performing strategy last quarter was Event Driven (+3.3%), aided by its exposure to corporate activity. Volatility across interest rates and equities helped Macro funds advance 2.6%. Multi-Strategy funds ended the quarter up 1.4%, with gains coming within credit and equity strategies. The laggards within CS HFI were Emerging Market (-2.9%) and Convertible Arbitrage (+0.3%).

Across the Callan Hedge FOF Database, volatility across equities and credit allowed the median Absolute Return FOF to gain 2.1%. With exposures to non-directional and directional styles, the Core Diversified FOF gained 1.2%. Long/Short Equity FOF was slightly positive at 0.06%; some managers had a tough September as mega cap tech exposure negatively impacted results.

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular for their attractive risk-adjusted returns that are uncorrelated with stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate risk premia such as value, momentum, and carry found across the capital markets. These alternative risk premia are often embedded in hedge funds as well as other actively managed investment products.

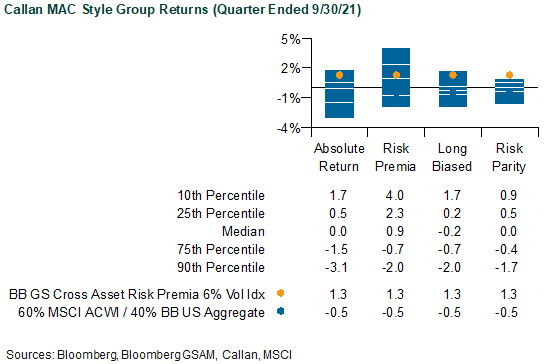

Measuring the quarter’s performance of these alternative risk premia, the Bloomberg GSAM Risk Premia Index increased 1.3% based upon a 6% volatility target. Within the underlying styles of the Index’s derivative-based risk premia, Commodity Carry (+2.9%) and Equity Quality (+2.1%) profited off strength in the energy and equity markets. The weakest risk premia were Bond Futures Trend (-2.2%) and Equity Value L/S (-2.1%), as interest rate volatility and value equities detracted during the quarter.

Within Callan’s database of liquid alternative solutions, the median managers of the Callan Multi-Asset Class (MAC) Style Groups generated mixed returns, gross of fees, consistent with their underlying risk exposures. For example, the Callan Risk Premia MAC rose 0.9% based on its exposures to uncorrelated style premia (such as those in the Bloomberg GSAM Index) targeting 5% to 15% portfolio volatility. This performance was supported by allocations to commodities and equity momentum throughout the quarter. The Callan Risk Parity MAC, which typically targets an equal risk-weighted allocation to the major asset classes with leverage, was flat. As the most conservative MAC style focused on non-directional strategies of long and short asset class exposures, the Callan Absolute Return MAC was also flat.

For the past 18 months, investing has had a smooth ride, but market volatility returned in September. We expect volatility to remain over the coming quarters as policymakers globally are beginning to pivot in response to higher inflation expectations. Central bankers have begun to announce plans to taper asset purchase programs and have provided guidance about interest rate increases over the coming months to neutralize the extreme measures taken in response to the pandemic. This should provide ample opportunities for strategies that focus on macro, relative value, and event-driven, all of which have the ability to opportunistically allocate capital across asset classes where they see profitable trades.