This blog post from Callan’s Private Equity Consulting Group provides a high-level summary of private equity activity in the third quarter through all the investment stages, from fundraising to exits, as well as performance data across a range of market cycles. (Investment-stage data provided by PitchBook; performance data from Refinitiv/Cambridge.)

Pressure on institutional investors to achieve returns well in excess of current income or dividend levels is fostering the popularity of gains-seeking investments. As a result, the private equity industry’s profile has risen markedly in the last several years.

That popularity and the growing trend toward “democratization” of the asset class for individual investors are drawing greater attention to the industry—including from presidential hopefuls.

Fundraising: Commitments Emphasize Larger Funds

- The number of funds holding final closes in the third quarter totaled 201, down 7% from the second quarter, but commitments jumped by $41 billion, or 27%.

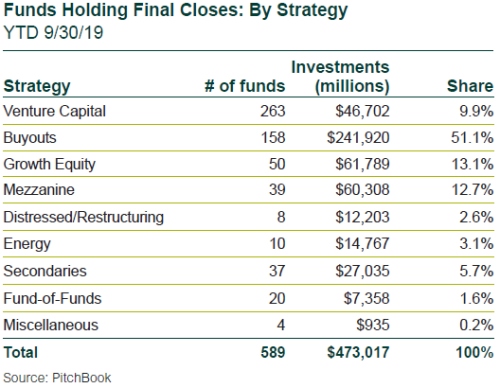

- Year-to-date commitments are running 7% or $37 billion behind 2018, with the fund count of 589 down 16%.

- We expect that the year-end rush will push 2019 fundraising past 2018’s commitment total but that the fund count will be lower, indicating more commitments to larger funds.

- No strategy is dominating the market compared to historical commitment ranges, as investors focus on diversification.

- Year-to-date, U.S. funds received 64% of global commitments, Europe 21%, Asia 13%, and the rest of the world 2%.

Buyout Investments: Slower Year

- The sustained high price environment is affecting the buyout sector’s investment volumes as late-cycle “assetflation” makes deal-level required returns more challenging to pencil-out.

- The number of transactions for the quarter totaled 1,491, down 14% from the second quarter. Dollar volume fell 16%, totaling $110 billion.

- The year-to-date investment count and dollar volume are significantly lower than 2018, with declines of 23% and 32% to 5,013 and $345 billion, respectively.

- The fact that fundraising continues to boom while capital deployment is slowing is a dynamic that investors should watch as portfolio uncalled commitment backlogs may begin to rise more than in recent years.

VC Investments: Moderating Trend

- Venture capital (VC) investments tipped downward from a relatively strong second quarter. The number of rounds of financings in the third quarter fell by 7% to 6,685, and the announced dollar volume declined 13% to $60 billion.

- Year-to-date, the count jumped 40% to 22,143 rounds, but announced fundings fell 12% to $185 billion.

- Large transactions were similar to the prior quarter with 39 financings of unicorns (VC companies with valuations of over $1 billion) in the third quarter, up a single round from the second quarter. The $10 billion of announced value is down $1 billion from the prior quarter.

- Year-to-date median pre-money valuations continued to rise, with the largest increase being Series C at 26% over 2018, although the median of Series D rounds is up only 2% compared to last year.

PE-Backed M&A Exits: Trending Up

- Third quarter private equity-backed M&A exits dipped a slight 6% to 404, but dollar volume rose 12% to $122 billion.

- Year-to-date exit activity based on announced dollar volume has been trending up from a low base due to the impact of the volatile final quarter of 2018. However, the year-to-date figures are well behind the strong volume in 2018. The deal count dropped 35% to 1,353, and announced volume skidded 40%, totaling $308 billion.

PE-Backed IPO Exits: Window Open Just a Crack

- Third quarter private equity-backed IPOs were lackluster, falling 62% by count to 16, and 63% by total raised to $6 billion.

- Year-to-date totals continue to lag last year, with the count down 47% to 68, and the total float falling 37% to $23 billion. Some recent bumpy IPO conditions in the venture area (Uber, Lyft, and the pulled WeWorks IPO) appear to be dampening appetite across the board.

Venture-Backed M&A Exits: Trending Down

- The third quarter was the weakest so far this year with venture capital exits falling 12% to 320, and 52% by announced proceeds to $12 billion.

- Year-to-date venture-backed M&A exits by count were down 13% to 1,058, and announced proceeds were down 12% from a year ago to $97 billion.

Venture-Backed IPO Exits: Culling the Herd

- The number of venture-backed IPO exits in the third quarter dipped by 20% to 47, and the combined new issuance dropped 59% to $9 billion.

- Amid the WeWorks debacle, the top three IPOs that successfully debuted in the quarter were Peloton, Douyu, and Datadog. Peloton was the largest representing 12% of the proceeds.

- The year-to-date total IPO count lagged 2018 by 21% with 133 offerings, and dollar volume trailed by 14% with $36 billion of aggregate proceeds.

- In the unicorn corral, Postmates decided to delay its IPO given market conditions, and Airbnb has stated that it is targeting 2020 for its public debut.

Returns: PE Lags Modestly in a Roller-Coaster 2nd Quarter

- U.S. public markets provided a roller-coaster ride in the second quarter but ended higher (Russell 3000 up 4.1%). Private equity lagged modestly during the quarter, providing a competitive 3.7% return.

- On a public market equivalent (PME) basis, the Refinitiv/Cambridge private equity database outperformed broad public equity indices over all longer horizons, except the 10-year horizon when the bull market began its run.

- All other standard investment horizons of one year or longer have produced double-digit internal rates of return (IRR) and have been competitive with public equity during the U.S. markets’ buoyant recovery after the Global Financial Crisis.