Private Real Estate

- The NCREIF Property Index, a measure of U.S. institutional real estate assets, rose 5.3% during 1Q22. The income return was 1.0% and the appreciation return was 4.3%.

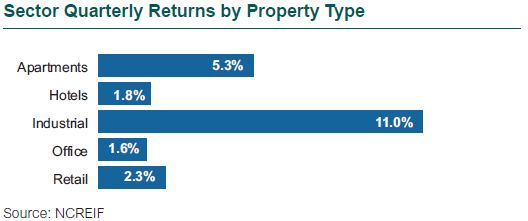

- Industrial led property sector performance with a gain of 11.0%. Office finished last with an increase of 1.6%.

- Regionally, the West led with a 6.5% increase, while the Midwest was the worst performer but still gained 3.5%.

- The NCREIF Open-End Diversified Core Equity (ODCE) Index, representing equity ownership positions in U.S. core real estate, rose 7.1% during the quarter.

- Valuations are reflective of strong fundamentals in Industrial and Apartment and continued uncertainty despite a modest recovery in Office and Retail.

- Office and Retail vacancy rates increased slightly during the quarter.

- Net operating income growth turned negative for Office as the Omicron variant delayed many return-to-office plans.

- Net operating income growth continued its gradual increase in Industrial while decreasing slightly in Apartment and Retail.

Public Real Estate

- The FTSE EPRA Nareit Developed REIT Index, a measure of global real estate securities, fell 4.0% during 1Q22.

- U.S. REITs, as measured by the FTSE EPRA Nareit Equity REITs Index, dropped 3.9%.

- The FTSE EPRA Nareit Asia Index (USD), representing the Asia/Pacific region, fell 1.0%.

- European REITs, as measured by the FTSE EPRA Nareit Europe Index (USD), fell 7.2%.

Real Assets

- Commodities were a rare bright spot given their inflation-protection properties as well as war-induced supply concerns. The Bloomberg Commodity TR Index soared 25.5% and the energy-heavy S&P GSCI climbed 33.1%.

- Gold (S&P Gold Spot Price Index: +6.9%) and listed infrastructure (DJB Global Infrastructure: +3.2%) outperformed global stocks and bonds.

- TIPS (Bloomberg TIPS: -3.0%) fell but outpaced nominal U.S. Treasuries.