Listen to This Blog Post

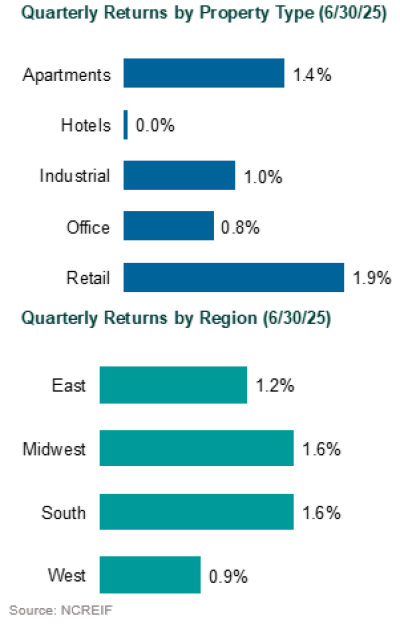

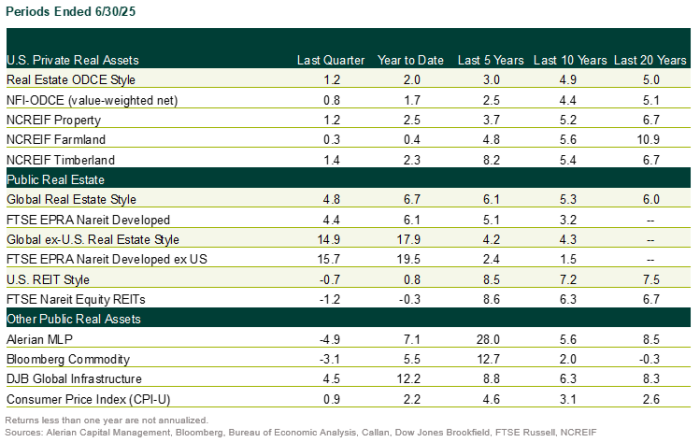

U.S. private real estate showed signs of early-stage recovery in 2Q25, as most property types saw appreciation returns—apart from Office and Hotel. Income returns were positive across regions and sectors, and signs of improvement in valuations and transactions hint at a market that may be emerging from a multi-year repricing cycle.

Private Real Estate | Valuations Stabilize, Activity Picks Up

The NCREIF Open-End Diversified Core Equity (ODCE) Index turned in a modestly positive quarter, and the NCREIF Property Index saw slightly higher gains, buoyed by sector appreciation outside of Office and Hotel. West region performance lagged, driven by continued repricing of industrial properties in Southern California. ODCE manager returns showed meaningful dispersion, reflecting divergent property compositions and differing exposures to challenged sectors.

Valuations appear to have bottomed. Transaction activity ticked higher on a rolling four-quarter basis and showed signs of momentum despite dipping slightly quarter-over-quarter. Macro policy volatility is hampering the recovery. Investors and managers are adapting to higher financing costs, with pricing reflecting increased borrowing rates.

Redemption queues in the ODCE Index have also eased significantly. After peaking at 19.3% of NAV in 1Q24, queues declined to an average of 12.0% of NAV in 2Q25. These declines reflect both rescinded redemption requests and improved liquidity through higher transaction volumes. While still elevated compared to historical norms, today’s queues remain below Global Financial Crisis levels, when they crested around 15% of NAV.

Dry powder for private real estate investment remains sizable, exceeding $230 billion in North America.

Capital Markets | Credit Tailwinds and Office Struggles Persist

Debt markets for commercial real estate remain tight. Bank issuance has increased, supportive of an increased transaction market. Loan maturities in 2025—especially in Multi-family and Office—are driving refinancing pressures, a legacy of short-term extensions granted during earlier periods of stress.

Capital market headwinds are most acute in the Office sector. Weak demand driven by remote work, expensive retrofitting needs, and tax pressures from strapped municipalities continue to weigh on values. Tenants favor newer, amenity-rich buildings, and most existing office inventory is not economically viable for conversion. Valuations remain 30% or more below peak levels, and transactions in the sector remain limited.

Despite these challenges, certain Office subsectors show signs of resilience. The highest quality and amenitized traditional office assets in strong sub-markets are exhibiting leasing strength. Medical office buildings, for instance, have maintained relatively stable fundamentals. Some land parcels encumbered by distressed office properties may present attractive redevelopment opportunities.

REITs | U.S. REITs Slip, Global REITs Lag Equities

Publicly traded real estate investment trusts (REITs) underperformed global equities in 2Q25. U.S. REITs declined 1.2% during the quarter, trailing the S&P 500 Index’s 10.9% gain. Global REITs rose 4.4%, but that too lagged the broader MSCI World Index, which advanced 11.5%. REIT valuations remain discounted relative to net asset value, with global REITs trading at a 10.5% discount versus a historical average of 4.0%.

Infrastructure | Deal Activity Stable, Fundraising Slows

Infrastructure investment held steady in early 2025. Global deal value closed 2024 at $1.1 trillion, a 15% increase year-over-year, with strong contributions from refinancing activity. Digital infrastructure and transport led the way, while the battery storage sector benefited from several large-scale projects.

Fundraising momentum, however, has cooled since its 2022 peak. Fewer exits and slower deal activity reduced capital distributions, in turn limiting LP capacity for new commitments. Still, appetite for infrastructure remains strong over the long term. The market continues to expand across closed-end and open-end vehicles, with growing interest in sector-specific strategies such as digital infrastructure and renewables.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.