Year in Review: Private Market Activity Maintains Strong Pace

View PDF In 2017, U.S. equity assets appreciated for the ninth straight year: The tax reform legislation passed by Congress fueled positive sentiment about future economic fundamentals, while the markets shrugged off Fed rate hikes. In the private equity market, company investments and exits trended strongly up during the year for buyouts, with venture capital […]

Low Volatility + Rising Markets = Strong Liquidity

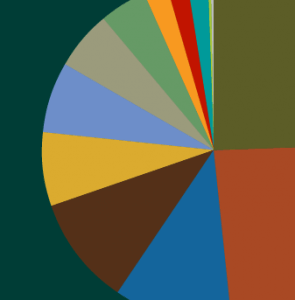

Low volatility and gently rising markets fostered ongoing “Golden Era” conditions in the private equity market. Fundraising is on pace to best last year’s post-GFC high; buyout and venture investments slowed slightly but dollar volume remained healthy.

Latest on the Private Markets

View PDF The private equity markets kept up their robust pace of fundraising in the second quarter. Buyouts continue to be the top strategy for limited partners, receiving more than 70% of commitments. Among the quarter’s other highlights: The share of money flowing to venture capital investments squeaked to double digits in the second quarter […]

Strong Start for Private Equity

View PDF The private equity market got off to a roaring start in the first quarter of 2017, with new commitments up sharply compared to last year. Here are some highlights from Callan’s Spring Private Markets Trends newsletter: Fundraising New private equity partnership commitments totaled $80.0 billion, with 310 new partnerships formed, according to Private […]

Private Equity on a Roll

View PDF New private equity partnership commitments totaled $80.0 billion in the first quarter, with 310 new partnerships formed, according to preliminary data from Private Equity Analyst. The number of partnerships jumped 75% from 177 in the first quarter of 2016, and the dollar volume rose 51% from $53.1 billion. KKR Americas Fund XII raised […]