Good Riddance to 2020!

Most of us are happy to say good-bye to 2020. And there are reasons for optimism as we head into 2021.

The Stock Market Is Not the Economy

The word “unprecedented” to describe the current environment may seem overused, but the speed and depth of the economic disruption was indeed unprecedented.

What Just Happened?

The full return of the economy depends on the confidence that we are safe to resume jobs, travel, consumption, and daily interaction. Until then, the global economy will be hampered in ways we can only partly anticipate; the unmeasurable risk of the global health crisis will dominate for some time

The Most Anticipated Recession in History Fails to Materialize

View PDF Real GDP grew at 2.1% for the fourth quarter of 2019, capping off a year pretty much no one anticipated for growth or the capital markets. GDP growth for the year came in at 2.3%, unemployment fell to yet another generational low, wages and incomes continued to show robust gains, and yet inflation […]

2019—A Surprisingly Lofty End to the Decade

From my post a year ago: “As widely expected … the Federal Open Market Committee (FOMC) voted unanimously to increase its federal funds rate target by 25 bps, bringing it to 2.25%–2.50%. … the year-end read of fed funds futures prices indicated a nearly 90% probability of no Fed hikes in 2019. … the FOMC also reduced […]

Global Headwinds Cloud Outlook for U.S.

The U.S. economy continued to perform reasonably well in the third quarter, with several September data points surpassing expectations. That said, global growth continued to languish, especially in manufacturing where trade wars have taken a toll. Inflation also remained stubbornly low. Against that backdrop, the U.S. dollar was a star performer, up 3.4% versus a […]

Resilience in the Face of Uncertainty

View PDF Investor confidence has shifted wildly over the past six months. Anxiety, panic, and gloom pushed equity markets down around the globe through the last three months of 2018, culminating in one of the worst Decembers in decades. The pessimism derailed global interest rate policy. The central banks in the euro zone had yet […]

The Global Economy Is Slowing. What Should Policymakers Do?

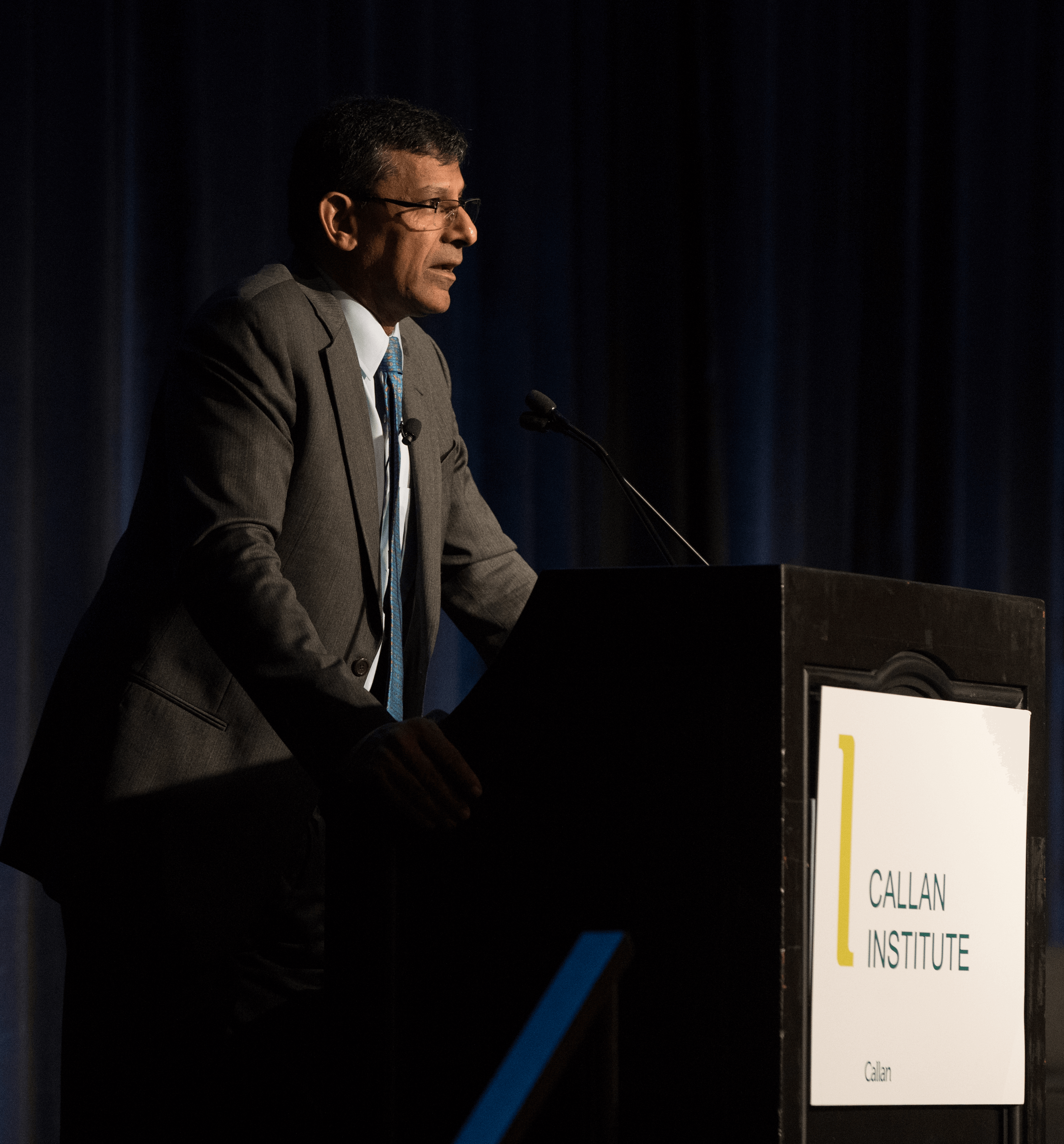

Speaking at Callan’s National Conference earlier this year, economist Raghuram Rajan discussed the state of the world’s economy as it entered 2019. At that time, most countries were experiencing a slowdown in economic growth and anticipated muted gains over the coming year. The reasons for the malaise differ from country to country. Or, as he […]

What Correction?

With the S&P 500 suffering its worst December since 1931, and the equity market falling by nearly 20% at one point during the month, suffice it to say that 2018 ended with a thud rather than a bang. However, just as we saw a snap-back from the drawdown in early 2018 (for different reasons), the […]

Change of Mind on Global Economic Growth

Markets Update Confidence in the strength of the global economy evaporated suddenly in October 2018, leading to sharp declines in equity and commodity prices, widening interest rate spreads, and an appreciation of the U.S. dollar. Little in the underlying fundamentals of the U.S. economy had changed: GDP enjoyed solid gains of 4.2% and 3.4% in […]