Callan Target Date Index™

Glidepath Allocation

The Callan Target Date Index Asset Allocation chart provides insight into the underlying asset class composition of the Callan Target Date Index over the full asset allocation glidepath. Multiple views offer varying degrees of detail into asset allocation.

The Macro Level View depicts the allocation over the course of the Index’s glidepath (40 years before retirement and 20 years after retirement) across nine major asset classes.

The Micro Level Views show the allocation over the course of the Index’s glidepath broken out into much more granular asset classes with options to examine equity and fixed income asset classes separately.

Use the drop-down menu to the right to see the different views.

Equity Rolldown

The Equity Rolldown Analysis chart displays the Callan Target Date Index’s equity allocation (excluding commodities and REITs) across the full asset allocation glidepath, including 40 years prior to and 20 years after retirement. The range in grey shows each target date vintage’s equity exposure at the 10th and 90th percentiles across the full glidepath.

Simply hover over the various lines in the chart to see the equity exposure for each vintage year.

Target Date Performance Snapshot

The Callan Target Date Index – Average of All Vintages chart gives a snapshot of the performance of the Callan Target Date Index. We show the aggregate performance of the universe of target date funds at a glance by equally weighting every “vintage” within the target date fund glidepath (e.g., 2015, 2020, 2025, etc.). The charts also show the range of performance of the Callan Target Date Index members, similarly weighted.

Click on the various vintage years to see the performance over time.

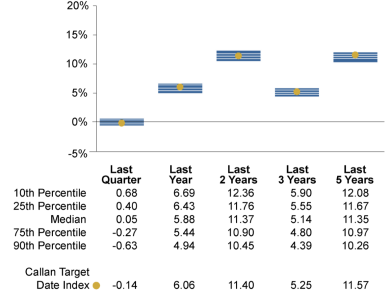

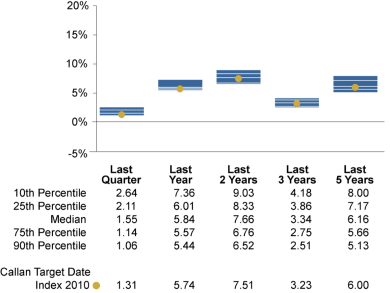

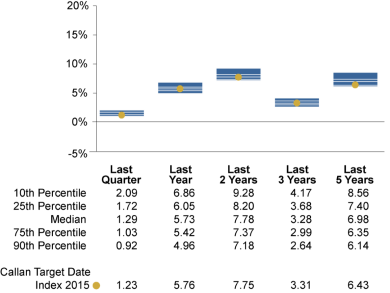

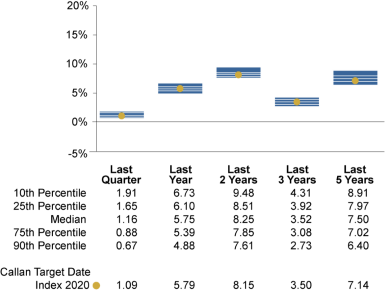

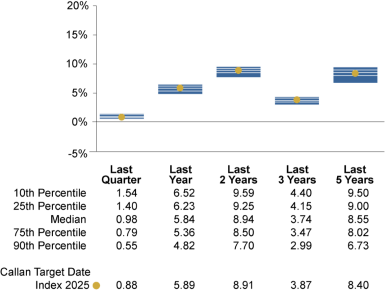

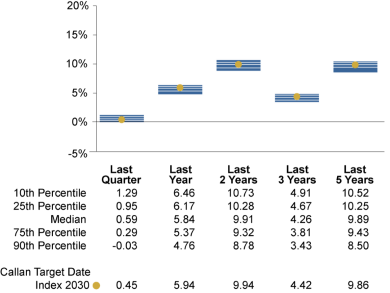

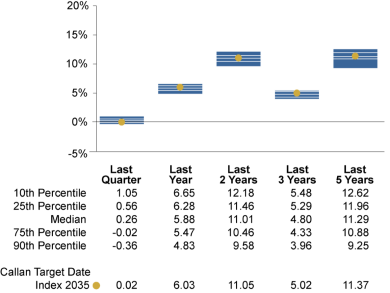

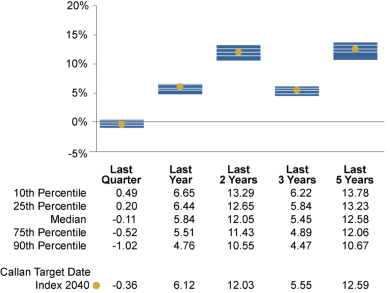

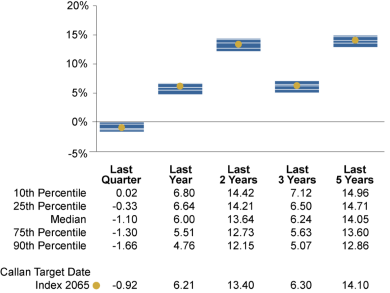

Index Performance as of 03/31/25

- Average of All Vintages

- 2010

- 2015

- 2020

- 2025

- 2030

- 2035

- 2040

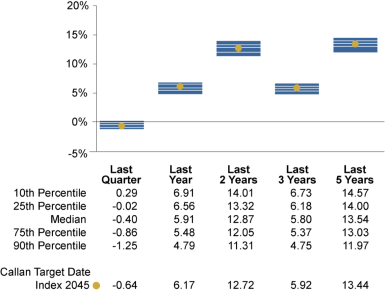

- 2045

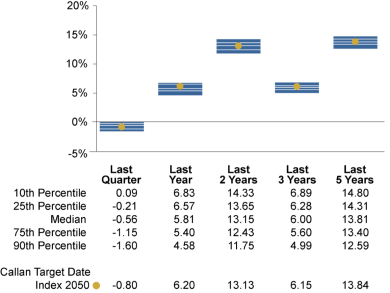

- 2050

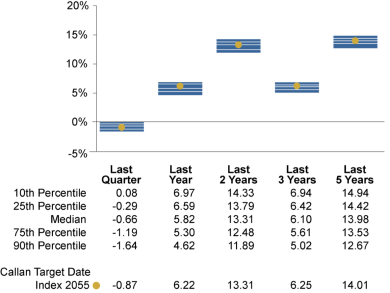

- 2055

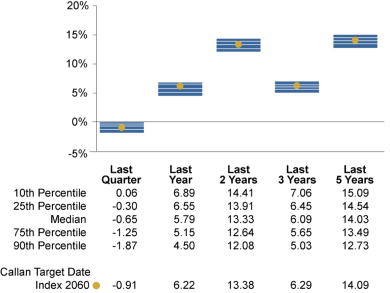

- 2060

- 2065

1Q25 Performance Overview

The Callan Target Date Index™ followed up a loss of 1.7% in 4Q24 with another loss of 0.1% in 1Q25. The median target date fund (TDF) manager outperformed the Index by 19 basis points in the quarter, widening the gap in one-year returns (5.9% for the manager vs. 6.1% for the Index). The gap narrowed for trailing five-year returns (11.4% for the manager vs. 11.6% for the Index).

1Q25 saw losses in U.S. equity markets and gains in U.S. fixed income markets. In the quarter, the 10th percentile manager gained 0.7% while the 90th percentile manager lost 0.6%. The one-year spread narrowed to 1.8 percentage points from the previous quarter’s 2.4 points.

.

The S&P 500 followed the previous quarter’s slight gain with a loss of 4.3% in 1Q25, and the Bloomberg US Aggregate Bond Index gained 2.8%. The median 2055 TDF manager fell 0.7% while the median 2025 TDF manager gained 1.0%. The median 2055 manager’s trailing one-year return (+5.8%) is the same as the median 2025 manager’s return (+5.8%), causing the one-year spread to narrow to 0.02 percentage points from the previous quarter’s 5.9 points.

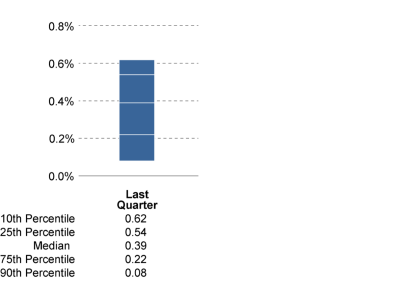

Expense Ratio Analysis

Expense Ratio

The Expense Ratio Analysis shows the distribution of expense ratios for funds within the Target Date Index. The group includes the lowest fee share class of mutual funds as well as collective trusts. For this universe, the median expense ratio is 39 basis points; the 10th percentile is 62 bps; the 90th percentile is 8 bps (i.e., the higher the fee, the lower the ranking). Much of the difference is driven by active versus passive implementation of target date glidepaths.

Methodology

The Callan Target Date Index is an equally weighted composite of 64 target date fund series, including both mutual funds and collective trusts. It is updated quarterly. To accurately benchmark a target date fund it is essential to determine an appropriate target date fund index. Many current target date indices simulate capital markets and derive an artificial glidepath to create a suite of target date indices.

.

This approach could be labeled biased or subjective—or even worse, arbitrary—because it does not objectively represent the target date opportunity set. After all, if a given target date fund’s performance differs from such an index, what does that really signify that is meaningful from an evaluation perspective? To avoid this problem, Callan constructed a consensus glidepath that is driven by the actual glidepaths offered within the industry.