Despite concerns over the Trump administration’s ability to follow through on promises of lower taxes and decreased regulation, the market accelerated higher in the first quarter.

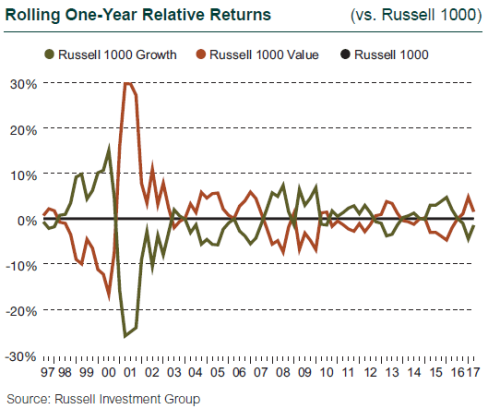

The S&P 500 Index hit a peak (2,396) in March and notched a 6.07% gain over the full three-month period. But the quarter was marked by reversals from the previous one—small cap fell behind large cap (Russell 2000 Index: +2.47% vs. Russell 1000 Index: +6.03%) and growth overtook value (Russell 1000 Growth Index: +8.91% vs. Russell 1000 Value Index: +3.27%).

The broader U.S. economy reflected the market’s optimism, and to no one’s surprise the Fed raised rates a quarter-point in mid-March. Wages continued to rise, consumer confidence was up, inflation moved closer to the 2% target, and unemployment fell to 4.7%. Yet some headwinds persisted in the U.S., with slowing GDP growth (the fourth quarter trailed the third, 2.1% vs. 3.5%), and significant issues abroad: elections and Brexit in Europe, the Syrian war in the Middle East, and South Korea’s presidential impeachment in Asia. Valuations in the U.S. remain high by various measures, but investors appear unfazed—for now.

Technology shares were especially strong; the FANG stocks—Facebook, Amazon, Netflix, and Google—hit record highs during the quarter. (Technically it should be the FANA stocks because Google is officially Alphabet—but FANG sounds better!) Micro and small cap companies ran out of steam after a strong 2016, while mid and large cap stocks charged ahead (Russell Microcap Index: +0.38%, Russell 2000 Index: +2.47%, Russell Midcap Index: +5.15%, and Russell 1000 Index: +6.03%). Value lost its lead over growth in all capitalizations (Russell 2000 Value Index: -0.13% vs. Russell 2000 Growth Index: +5.35%). The dispersion in style returns was broad across market capitalizations.

Reflecting the reversal in investor preference, the best-performing sectors in the S&P 500 Index during the quarter were growth-oriented; Technology (+12.57%) was No. 1, followed by Consumer Discretionary (+8.45%), and Health Care (+8.37%). After leading in the fourth quarter, Financials (+2.53%) and Energy (-6.68%) trailed the broad market in the first. Both Health Care and Financials traded on President Donald Trump’s failure to amend the Affordable Care Act—Health Care stocks gained on the certainty of the status quo and Financials dropped on fear the administration may fall short on deregulation and tax reform as well. Energy was the worst-performing sector during the quarter as last year’s agreement by the Organization of the Petroleum Exporting Countries (OPEC) has not reduced fears of oversupply or meaningfully increased the price of oil.

As the U.S. equity market powered on, valuations across indices traded at historically high levels—the S&P 500 Index NTM (next 12 months) P/E was 17.5x versus the 25-year average of 14x as of March 31, 2017. Correlation (measured by S&P 500 stocks) ended the quarter below average and at levels not seen in 10 years, a positive for active management. Volatility (as measured by the CBOE Market Volatility Index, or VIX) also tracked below its average, seemingly unfazed by geopolitical uncertainty.

6.07%

The S&P 500 Index’s gain in the first quarter.