Amid this highly unusual and uncertain market environment, institutional private equity programs must navigate a number of challenges in an effort to realize their expected return potential, including:

- The cascading human, social, economic, monetary, and policy implications of the COVID-19 pandemic

- A contentious 2020 election cycle characterized by divergent policy proposals between candidates and between political parties, compounded by uncertainties around recognized election procedures and norms

- The highly volatile public market environment, including sharp and rapid declines early in the year followed by an equally quick recovery

These challenges have obstructed visibility into (i) the composition of, and level of exposure to, the private equity allocation; (ii) the positioning of the private equity program relative to strategic portfolio- and private equity program-level objectives and constraints; and (iii) the competitive fit of existing general partner (GP) relationships and fund series relative to new GP relationships and tactical investment opportunities.

In a series of blog posts, we plan to review focal points of private equity portfolio management to enable greater visibility into investors’ private equity programs and provide practical steps to optimize private equity programs’ return potential. Specifically, these blog posts will address:

- The importance of maintaining strong oversight of the in-place private equity program, particularly after periods of disruption

- The role and outcomes of a strategic review of a private equity program

- Strategies for investors to narrow the lens on investment priorities and sharpen the view toward opportunities of best fit

- How these three portfolio management focus areas weave into a clear, panoramic perspective of private equity implementation

Overseeing the Private Equity Program

In volatile times like these, institutional investors may be inclined to focus on new investment activity as the primary means to play offense. While this may be appropriate in some circumstances, for mature private equity portfolios the most impactful source of returns during a period of recovery is the in-place private equity portfolio.

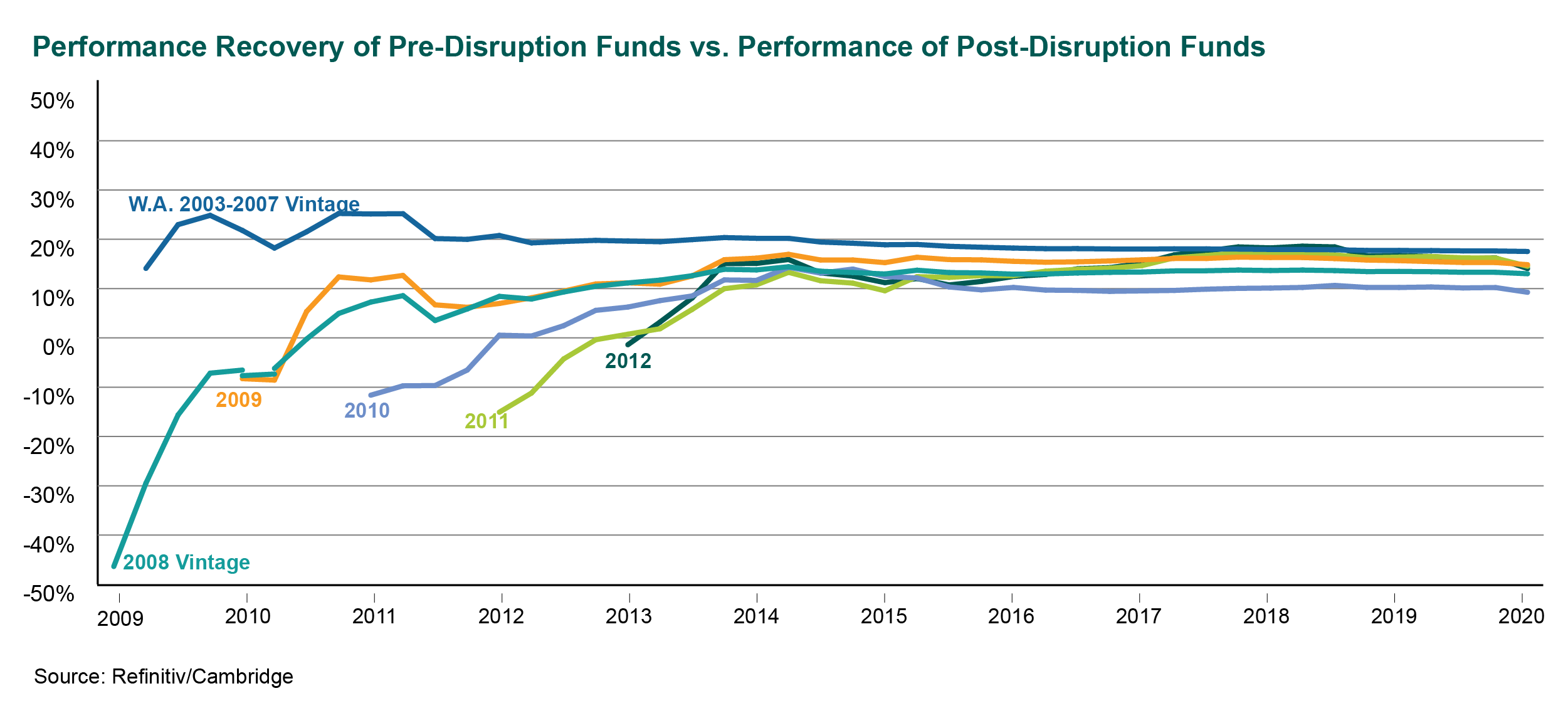

To demonstrate this, we analyzed the quarter-by-quarter net internal rates of return for 2003-07 vintage buyout funds before, during, and after the Global Financial Crisis (GFC).

This chart illustrates the magnitude and pace of gains ahead of the GFC, the declines as the contraction took hold, and the performance recovery that followed. (Internal rate of return is one of the critical performance metrics for private equity portfolios, and is a capital-weighted return that provides a single cumulative figure since inception of the portfolio.)

While the declines across vintage years were substantial, so too was the pace of recoveries, which were a function of (i) the level and performance of invested but unrealized capital exposed to the declines; (ii) the level of realized performance prior to the declines; and (iii) the amount of, and the performance of, capital available for investment/reinvestment following the declines. Some of these factors broadly drove the outpaced recovery of 2007 vintage buyout funds relative to the 2006 vintage.

Comparing Performance Recoveries to New Fund Performance

Interestingly, the performance of the unrealized holdings exposed to the market declines outpaced the relatively strong performance results of new funds that were raised and invested in an opportunity-rich, post-GFC environment.

We illustrate this in the following chart, showing:

- Proxy for Performance Recoveries of Pre-Disruption Funds: Quarterly net internal rates of return, generated from mid-2009 trough values onwards, for 2003 through 2007 vintage funds (combined on a weighted average basis)

- Proxy for Performance of Post-Disruption Funds: Quarterly inception to date net internal rates of return for each of the 2008 through 2012 vintage years

As the chart illustrates, while the performance profile of new, post-GFC funds was generally favorable, the performance recovery of the pre-GFC funds was both superior and immediate.

Still, while the dollars already “in the ground” broadly generated better performance from trough levels than the performance of new private equity fund investments, steps can be taken to further advance the positioning of the in-place private equity portfolio.

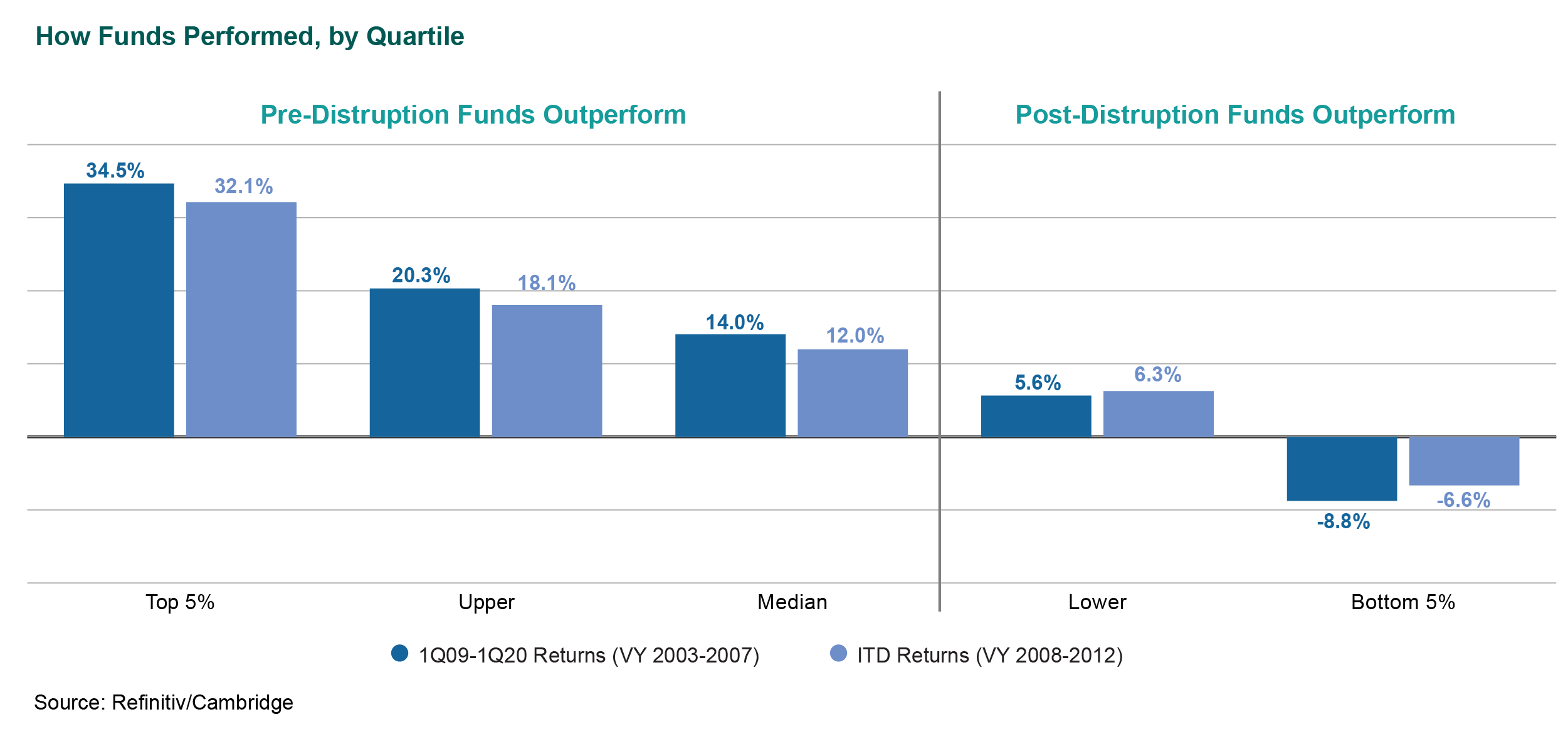

The following chart compares the performance distributions of the pre- and post-GFC funds from trough 1Q09 levels.

This chart shows that the performance recoveries of the pre-GFC funds tended to outpace similarly ranked post-GFC funds by over 200 basis points; however, the segment of underperforming pre-GFC funds generated lower performance than similarly ranked post-GFC funds.

Takeaways

Investors tend to focus on new capital investment as the primary means to play offense, particularly during and after a contractionary market environment. But for mature private equity programs, a superior starting point can often be the in-place private equity portfolio, in which the recoveries on capital already invested have tended to outpace the returns generated on newly invested capital.

As a result, Callan recommends that investors:

- Conduct a comprehensive review of the investments in the private equity program, including an assessment of performance results and a refreshed view about performance expectations

- Maintain close ongoing oversight of the PE program to track key investment and performance milestones in light of refreshed expectations

- Continually monitor the effectiveness of their GPs in driving performance recoveries of existing fund investments and their role and continued fit with the objectives of the PE program

- Where appropriate, actively identify core and non-core private equity fund holdings and engage with GPs in pursuit of enhanced transparency, efficiencies in reporting processes, and improvements to investor governance

- If necessary, develop game plans around liquidity opportunities, including rights and opportunities to invest in GP- or investor-led liquidity solutions for core holdings, as well as opportunities to drive or participate in GP- or investor-led secondaries transactions for non-core holdings

Our Next Blog Post:

Building on a well-developed perspective of the in-place private equity portfolio, our second blog post will focus on the role and outcomes of a private equity strategic review to foster (i) continued advancement of an investor’s private equity program objectives; and (ii) improved fit of new investments with existing holdings.