Listen to This Blog Post

After decades of mixed sentiment, nuclear energy is re-emerging as a vital piece of the global decarbonization puzzle. Rising electricity demand from AI-driven data centers, electric vehicles, and heavy electrification is colliding with the urgency to cut greenhouse-gas emissions, prompting policymakers and corporations alike to give nuclear a fresh look. Here’s how the landscape is evolving—and where the opportunities for institutional investors and investment managers may lie.

A Quick Rewind on Nuclear Power

U.S. nuclear generation has supplied roughly one-fifth of U.S. electricity for more than a decade, yet the reactor fleet has been shrinking: from a peak of 112 operating units in 1992 to 94 today, as aging plants met cheap natural-gas competition. Closures outpaced additions until 2023-24, when Georgia’s Vogtle Units 3 and 4 became the first large reactors to connect to the grid in nearly a decade.

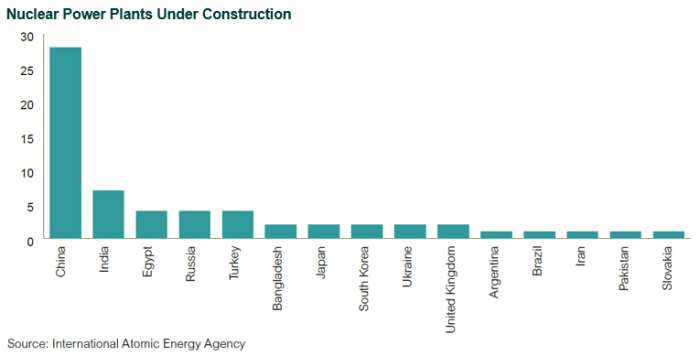

Globally the count is similar: 413 operating reactors at year-end 2023, down from 437 in 2004, largely because of the post-Fukushima shutdowns. But construction activity—particularly the 28 units underway in China—signals the long decline may be reversing.

Why Nuclear Power Is Back on the Table

- Climate math: Electricity demand is growing fast: each year the world will add consumption equal to the 10 largest cities, according to the International Energy Agency. Renewables are scaling quickly but not fast enough to displace fossil fuels on their own, leaving a gap for always-on, zero-carbon nuclear power.

- Grid reliability: Solar output swings seasonally; wind ebbs in mid-summer. Nuclear plants typically run at capacity factors above 90 percent, providing stability and complementing intermittent renewables.

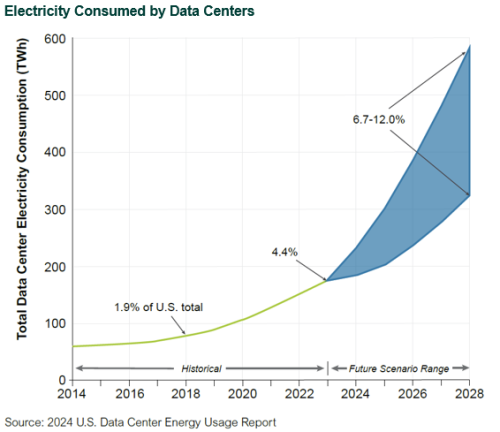

- Data-center surge: U.S. data-center electricity use could more than double between 2023 and 2028, driven by AI workloads that consume almost 10 times the energy of a traditional web search. Tech giants are turning to nuclear to secure long-term clean power.

- Electrification of transport: Global electric-vehicle sales have ballooned from approximately 100,000 in 2012 to more than 16 million in 2024, adding another structural source of demand.

Bipartisan Policy Tailwinds

In the U.S., rare bipartisan consensus has translated into meaningful incentives. The Inflation Reduction Act of 2022 introduced a production tax credit for existing reactors, while the earlier Energy Act of 2020 funded the Advanced Reactor Demonstration Program. At the state level, California’s legislature approved a $1.4 billion loan to keep Diablo Canyon running, backed by a further $1.1 billion in federal civil-nuclear credits. Michigan’s shuttered Palisades plant secured a $1.5 billion DOE loan to restart in 2025—the first U.S. reactor ever to return from retirement.

The Promise of SMRs

Traditional reactors are capital-intensive and slow to build—a key hurdle as two-thirds of the world’s fleet now tops 30 years of age. Enter small modular reactors (SMRs): factory-built units that produce about one-third of the power of a conventional plant, assembled on-site to slash costs and schedule. Bill Gates-backed TerraPower is constructing a 345 MW sodium-cooled reactor in Wyoming that integrates molten-salt energy storage, aiming to deliver 500 MW of peak output for roughly $4 billion—an order of magnitude cheaper than Vogtle. Other players include NuScale, Rolls-Royce, X-energy, and Oklo. Passive safety features, flexible siting, and modular scalability could make SMRs a cornerstone of the next-generation grid.

Big Tech’s Nuclear Play

Alphabet, Amazon, and Microsoft are not waiting on the sidelines:

- Google agreed to purchase power from Kairos Power’s fluoride salt-cooled high temperature reactor SMRs.

- Amazon invested $500 million in X-energy and is exploring SMRs adjacent to its Virginia data campuses.

- Microsoft struck a 20-year deal to buy output from a restarted Three Mile Island unit and hired a dedicated nuclear-technology lead to weave SMRs into its data-center portfolio.

- OpenAI’s Sam Altman chairs fusion startup Helion Energy and incubated reactor developer Oklo.

Where the Money Flows

Nuclear decommissioning trusts (NDTs): U.S. NDT assets exceeded $80 billion at year-end 2022 and likely topped $100 billion after two strong market years. As SMRs proliferate, each will require its own NDT—smaller per reactor but additive in aggregate—broadening the pool of assets that need prudent, multi-decade investment management.

Private equity and venture capital: Deal value in advanced-nuclear companies during 2024 surpassed the prior 15 years combined, reflecting growing conviction. Funds are targeting everything from reactor developers to uranium enrichment, where U.S. market share is below 1 percent. These are high-risk, long-duration bets, but the addressable market could be vast if SMRs achieve commercial scale.

Bottom Line

Nuclear energy’s blend of baseload reliability and carbon-free generation makes it a critical complement to renewables as they work to supplant fossil fuel power. Policy support, technological innovation, and corporate demand are converging to give the industry its best tailwinds in decades. For institutional investors and investment managers, the resurgence opens a spectrum of opportunities—from NDT portfolios to growth-oriented stakes in SMR developers and fuel-supply chains. Diligence remains paramount, yet the sector’s renaissance could help power both portfolios and the planet toward a lower-carbon future.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.