Infrastructure can be broadly described as facilitating the movement of people, goods, and ideas, and it is essential for the economic productivity of a society. Infrastructure assets include regulated utilities, transportation assets, energy assets, communication assets, and social infrastructure.

Before the Global Financial Crisis (GFC), traditional banks were responsible for nearly 90% of infrastructure debt finance, according to Preqin. But post-GFC regulations limited the ability of banks to provide these loans. After the GFC, managers began offering a variety of options for investors to access both investment-grade and non-investment grade unlisted infrastructure debt.

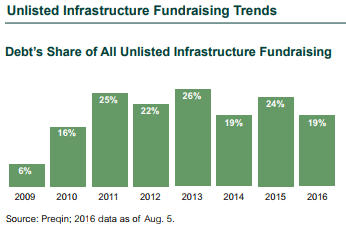

Unlisted infrastructure debt funds grew from 6% of all unlisted infrastructure fundraising in 2009 to 26% in 2013, which shows the relatively recent rise of infrastructure debt as an investment opportunity. And from 2009 to 2016, 89 unlisted infrastructure debt funds reached final close, with over $43 billion of capital raised. The variety of infrastructure debt opportunities continues to increase as the sector matures.

Private infrastructure investment owners may seek debt across a wider range of options, including senior debt, mezzanine loans, and preferred equity. Infrastructure owners typically use project finance loans secured by the underlying asset, and lenders have limited if any recourse to the owner’s other assets. This debt is typically serviced solely by the cash flows from the financed asset. Infrastructure owners sometimes arrange debt at the corporate level for expansion projects, and those loans may be serviced by the corporation’s income rather than a specific asset. Investors need to understand the type of collateral risk an infrastructure debt manager will consider to deliver its target return and evaluate whether the return is commensurate with the risk.

There are no set rules about which type of debt is used for a specific kind of infrastructure asset:

- Mature asset owners typically employ fixed-rate financing, as they seek longer-term debt and want to avoid pre-payment scenarios to better match their liabilities over lengthy periods of time.

- Greenfield investment projects more often use floating-rate debt, with shorter maturity schedules that match business plans.

- Brownfield investments may use a mix of both, with floating-rate entity-level financing used for expansion or growth plans.

Loans can be tailored to meet duration objectives, and rates are often set as a function of a base rate, e.g., LIBOR plus a fixed spread.

Infrastructure debt is becoming easier for institutional investors to access. The number of infrastructure debt fund sponsors is growing and there is potential to access it through separate accounts. Infrastructure debt has the potential to deliver bond-like yields for core assets, or higher levels of return—along with more risk—as part of brownfield and greenfield infrastructure debt investment. Investors building out an infrastructure allocation should consider the role of infrastructure in their portfolio, primarily target returns, and select the type of investment that best fits their risk/return targets.

For more about this asset class and its potential benefits as well as risks for institutional investors, please find my paper on the topic here.

The percentage of unlisted infrastructure debt funds as a share of all unlisted infrastructure fundraising in 2013.