Listen to This Blog Post

U.S. equities extended gains for the year and advanced to record levels as investors looked through policy uncertainty and focused on earnings and Fed easing prospects. Global ex-U.S. equities extended their year-to-date lead over U.S. markets. Fixed income markets posted broad-based gains in 3Q25. Global bonds delivered mixed performance as 10-year bond yields rose across most G7 nations and U.S. dollar strength was a headwind to unhedged investors. Liquid alternatives posted positive returns in 3Q25, with strength concentrated in precious metals.

How Global Markets in 3Q25 Did

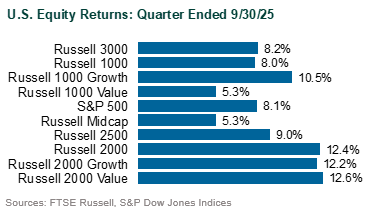

U.S. Equities: The S&P 500 rose 8.1% (+14.8% YTD), led by Information Technology (+13.2%) and Communication Services (+12.0%) on continued enthusiasm for the AI trade and digital platforms. The Magnificent Seven stocks were propelled further as they reached approximately 35% of the S&P 500’s market capitalization. Consumer Discretionary (+9.5%) also posted strong gains, while Consumer Staples (–2.4%) was the weakest sector reflecting a rotation into cyclical names as well as a weaker outlook stemming from increased margin pressures on these companies. Small caps (Russell 2000: +12.4%) outperformed large caps (Russell 1000: +8.0%), and growth stocks (Russell 3000 Growth: +10.4%) continued to lead value (Russell 3000 Value: +5.6%).

Market valuations grew further into focus as the Schiller P/E ratio for the S&P 500 ended the quarter at roughly 40x, reaching a level that has only been exceeded by the rally prior to the Dot-Com Bubble. Similarly, the market-cap-to-GDP Ratio, also known as the Buffett Indicator, surged past 200% in September, signaling that market gains have far outpaced U.S. economic growth.

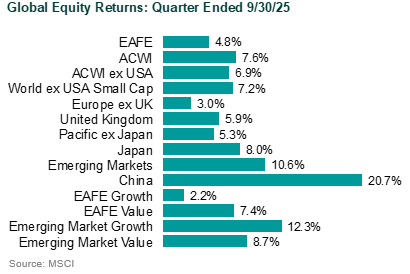

Global Equities: The MSCI ACWI ex-USA Index rose 6.9% (+26.0% YTD). The currency tailwind abated during the quarter as the U.S. dollar stabilized (DXY: +0.9%) after a tumultuous 1H25 (-10%). Developed market equities (MSCI World ex-USA: +7.3%) advanced as the European Central Bank paused its easing cycle and the Bank of Japan maintained its accommodative stance. Financials (+8.6%) were the strongest performers as European banks posted solid 2Q earnings, while Health Care stocks (+0.7%) faced pressure from newly announced U.S. tariffs on imported pharmaceuticals. Japanese equities (+8.0%) rallied, led by autos and semiconductors, as a U.S.-Japan trade deal was reached in July and finalized in September, helping boost investor sentiment on exporters.

Emerging market equities delivered strong gains (MSCI EM: +10.6%), led by Chinese equities (+20.7%). Despite signs of economic deceleration, investor sentiment was lifted by potential government intervention to address overcapacity in the Chinese economy, easing in trade tensions with the U.S., and progress on AI and chip technology. South Korean (+12.7%) and Taiwanese equities (+14.3%) also surged ahead in 3Q, benefiting from strong semiconductor demand.

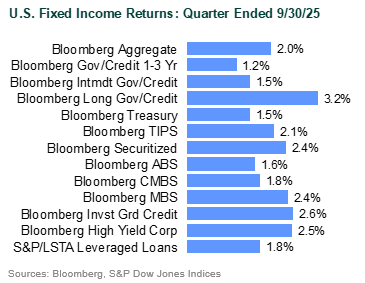

Fixed Income: The U.S. Treasury yield curve steepened modestly as the front end fell more sharply in anticipation of Fed cuts, while the long end shifted marginally lower but remained elevated. The Bloomberg US Aggregate Bond Index advanced 2.0% (+6.1% YTD) as yields declined. Investment grade corporate bonds outperformed securitized (MBS, CMBS, ABS) on a like-duration basis as corporate option-adjusted spreads continued tightening and reached levels last seen in the pre-GFC period. Within leveraged finance, spreads also continued to grind tighter as the Bloomberg US High Yield Index rose 2.5% and the Morningstar LSTA Leveraged Loan Index advanced 1.8%, supported by strong CLO demand. The Bloomberg TIPS Index gained 2.1% (+6.9% YTD) as the 10-year breakeven increased and the implied 10-year real yield declined. Municipals generated solid returns (Bloomberg Muni: +3.0%), aided by favorable technicals and strong demand.

The Bloomberg Global Aggregate Index (USD Hedged) gained 1.2%, while unhedged returns were nearly flat (Bloomberg Global Agg: +0.5%). Emerging market debt outpaced developed market peers, with the hard-currency (JPM EMBI Global Diversified: +4.8%) and local-currency (JPM GBI-EM Global Diversified: +2.0%) indices both advancing.

Listed Real Assets: The S&P GSCI rose 4.1%, though performance across underlying sectors diverged. Precious metals surged (S&P GSCI Precious Metals: +17.4%), with gold up roughly 45% YTD as elevated uncertainty bolstered its appeal as a safe-haven. In contrast, energy prices remained under pressure as oil markets faced ample supply. Global natural resource equities advanced (S&P Global Natural Resource Equities: +9.4%), lifted by strong gains in metals and agriculture that offset weakness in energy. REITs also posted gains (FTSE Nariet: +4.8%), supported by a modest decline in long-term yields.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.