The fast-moving coronavirus outbreak and the even faster-moving equity market response to the uncertainty present a significant downside risk to the global economic outlook. Callan does not have anything to say about the epidemic itself, and a lot of great research has already come out from the asset management community.

What we can offer is perspective and context for looking at the current situation. In other words, we can comment on how reactions to shocks have played out in the past, and remind people of their typical transitory effect. We want to assure our clients that we are on top of developments. We take the impact of consumer, investor, and policy responses seriously, but we do not believe the end of the world is nigh.

Among the more significant variables are how the coronavirus will be contained and how long it will take to effect containment. In most natural disasters, the immediate economic impact is sudden and painful, but the end of the disaster typically sparks a sharp, V-shaped recovery. Production and consumption are delayed, and often snap back quickly. The longer it takes for the coronavirus to be contained and the more it spreads across the globe, the likelier it is that the bounce-back turns out to be a series of localized V-shaped recoveries that merge into a global U-shaped recovery.

The immediate impact from shuttered businesses is a halt to production that results in an interruption to supply chains around the world. Workers and consumers held at home reduce both consumption and production. The consequent impact on revenue, profit, wages, and incomes will build the longer the situation remains uncontained. The impact from the coronavirus has been immediate—most notably on the travel, tourism, and transportation sectors. Further on down the road, it is possible that inflation can emerge. Regarding the potential impact on inflation, we will be watching to see if the supply side of economic production remains constrained.

The equity moves are substantial, greater than 10% across markets, with two interesting features. First, the declines are now global, no longer centered on the initial impact regions of China, South Korea, and Italy. Second, the depth of the decline, while not out of line with other stock market corrections, suggests a potential drop in global GDP, including for the U.S., that seems exaggerated. The pressure on central banks to ease is tremendous, even though easing may not necessarily be an ideal solution to this immediate crisis, and central banks have few arrows left in their quiver with historically low rates. On Friday the Federal Reserve, in a statement from Chair Jerome Powell, indicated that it “is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.” The pressure to engage in fiscal stimulus is also growing.

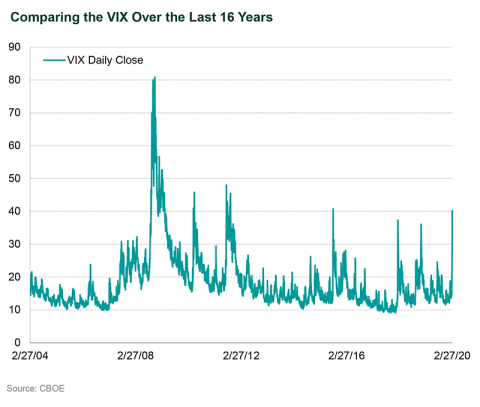

Fear is clearly driving the equity markets. The VIX—often referred to as the “fear index”—came close to 50 in mid-day trading on Feb. 28, the highest level since the Global Financial Crisis (GFC). The VIX is a good representation of the demand for options, and demand for options as a form of protection is high by historical measures. For perspective, we need to remind ourselves that a 10%-12% drawdown, no matter how quickly it occurs, is not that remarkable for equity markets. Also recall that global equity markets were up substantially in 2019, and valuations have crept toward richer levels.

Yields for U.S. government bonds have broken through their historic lows, and the bond markets are clearly expecting central bank easing. However, credit spreads have not widened much so the ever-pessimistic bond markets are not (yet) forecasting widespread bankruptcies.

In short, it is Callan’s belief that there are no reasons to abandon a long-term investment plan. If we all believe that the Global Financial Crisis was ultimately a stay-the-course event, then we would argue that this coronavirus event is one as well.

The risk is that this coronavirus outbreak goes on long enough without meaningful containment to truly erode real economic growth and, more importantly, confidence, setting off a cycle of self-fulfilling recessionary behavior. The central banks will be forced to use up their thin supply of easing tools in advance of the onset of recession. The history of natural disasters suggests that a V-shaped bounce-back is the most likely result, dependent on the containment of the virus.

Finally, we wish to assure our clients, colleagues, and our treasured associates that we have a well-formed contingency plan to help keep our employees safe and working productively.