Because general partners only raise funds every three to four years, it is essential for institutional investors to stay ahead of private equity fundraising activity. Especially with the accelerated pace of fundraising in today’s market environment, it is easy to overlook a potential investment opportunity.

To manage this process more effectively, Callan has developed what we call the “Global Forward Calendar,” a tool to assist in the long-term planning of an investor’s private equity portfolio and the pacing of fund commitments. It tracks the timing of private equity fundraising and indicates when general partners are expected to come back to market with their next fund. The Calendar serves as a useful tool to compare available offerings across a peer group of similar, or potentially more compelling, investment alternatives.

In constructing the Callan Global Forward Calendar, we start with a universe of over 20,000 funds gleaned from general partners, industry events, trade publications, third-party databases, and publicly available information. We use this data to project the timeframe in which a follow-on fund may come to market. Of course, the calendar provides a general estimate since the timing of a particular fundraising may vary depending on the strength of the economy, investor appetite for private equity, or idiosyncratic decisions by the general partner. But the Calendar provides a useful tool for identifying fundraising trends and evaluating private equity commitment pacing.

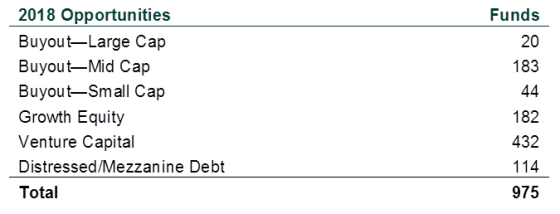

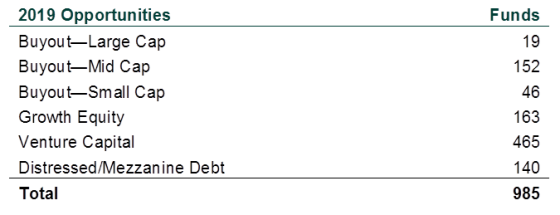

The tables below highlight our expectations for fundraising activity over this year and next, showing the number of funds expected to come to market for each strategy type:

Although the number of large cap buyout offerings looks small, they dominate the fundraising market in terms of dollars targeted. Likewise, the high number of venture capital funds is deceptive; the majority are very small funds and represent a minority of dollars targeted.

The Global Forward Calendar also provides a way for us to prioritize general partner outreach efforts and ensure we stay ahead of their fundraising activities.

As they search for increased returns and portfolio diversification, institutional investors are likely to expand their allocations to private equity. And the robust fundraising environment has led to a rise in the number of funds available. Given this environment and the complex nature of the private equity market, the Calendar offers an effective way to identify fundraising trends, help set investor priorities, and provide strategic direction to portfolio allocations.

For more information on the Callan Global Forward Calendar as well as the general partners and funds Callan is actively reviewing, or other questions, please reach out to Callan’s private equity team at [email protected].